For many Canadians, managing everyday finances can be a big puzzle. Sure, we know we need to save for a rainy day and for retirement. We know managing debt is important, and a credit rating can make or break whether we get a loan. And for a good many of us, financial knowledge ends there. This, however, is where financial advisors pick up the baton.

Table of contents

Is becoming an advisor and helping other Canadians meet their financial goals of high interest to you (no pun intended)? To become an advisor in Canada, you actually don’t need a Master’s degree in Finance or Business. You do, however, need a certain level of understanding and knowledge of investments, insurance, and financial management. Ultimately, you’ll likely need to pursue certification courses and register with a regulatory body.

This primer will give you a better idea of the steps you need to take to work as an advisor in Canada.

What is a financial advisor?

In a nutshell, financial advisors give advice on managing your money, reaching your financial goals, and preparing for potential risks or financial blows. Debt management, planning for retirement, maximizing income and savings, building a portfolio of investments, and even insurance and tax issues — all of these financial problems fall under the purview of a financial advisor.

Sounds simple, right? Well, the thing is, ‘financial advisor’ is actually a bit of a catchall. Under this umbrella term, you’ll find a number of specialized professions and designations, such as:

- Financial planner

- Mutual fund dealer

- Portfolio manager

- Insurance advisor

- Financial coach

As with any of these specific jobs, an advisor’s main priority will always be keeping the client’s financial goals — and their trust — a priority. A great advisor will be able to make their clients feel comfortable, thoroughly explain their processes/decisions, and answer client questions. In addition, many financial advisors find a niche and focus on serving their clients with those specific problems. Part of the career path involves finding a niche you’re skilled at which helps you and your clientele.

FYI: The Canadian Securities Institute (more on the CSI below) has a great financial services career map and job finder tool, outlining the various roles in the industry and the recommended courses and credentials needed.

Types of financial advisors

So, what *are* the differences between the various roles you can find under the generic ‘financial advisor’ label? Let’s break down some common ones.

What is a financial planner and what do they do?

‘Certified Financial Planner’ or CFP is one of the most widely-known designations in the financial services industry. Planners help clients clarify their financial and life goals. In addition, they give you a roadmap to reach those goals. Based on your income, they plan and manage your investment portfolio and your insurance needs. Finally, they guide you toward a financially stable life and eventual retirement.

It’s a common belief that financial planners are only a need of the wealthy. However, this is an all-too-common myth. While there are fee-only planners (and specific wealth management services for high-net-worth individuals), the truth is that the right certified financial planner can help you work toward meeting your financial goals — no matter what they are or your income level.

Ultimately, every income level can benefit from good financial planning. If you’re not sure whether you’d benefit from a certified financial planner, it might be time to start looking into hiring one.

What is a financial coach and what do they do?

Financial coaches (also called ‘money coaches’) don’t have the same specialized training in individual aspects of investments and insurance. Instead, coaches help clients set up — and stick to — a financial plan, without necessarily selling financial products. With this in mind, they work with clients to:

- Define their unique goals

- Budget cash flow

- Determine their actual needs

- Consider their personality, lifestyle, and spending habits

- Address their relationship with money

Ultimately, money coaches provide strong accountability and motivation for those looking to take control of their personal finances.

Perhaps you are like many people who rack up credit card debt month after month, never managing to get ahead. Or, maybe you’re so scared of falling into debt that you have a limited credit history. Neither one is a healthy relationship with money. A financial coach works with clients to improve that relationship through guidance, support, and educated advice.

What is an investment advisor and what do they do?

Investment advisors recommend quality investments and strategies that align with the individual needs and goals of a client.

Carefully monitoring the market and industry trends, investment advisors provide advice on securities like mutual funds, stocks, and bonds, working with you to build and manage a portfolio of investments that suits your financial situation, and both long- and short-term goals.

In return, advisors usually receive a commission or a flat fee for their services. Typically, investment advisors work for firms — either independent or bank-owned.

What is a financial consultant?

A financial consultant is a term that is sometimes used interchangeably with financial advisor. In general, financial consultants may guide investors on a variety of financial areas including retirement planning, investments and insurance. Requirements to be a financial consultant would be similar to those for financial advisors.

What are the requirements for becoming a financial advisor?

While there’s no formal ‘financial advisor’ designation, there are still steps you need to take if you’re going to pursue just about any of these career paths. As we mentioned above, you’ll (likely) need to take certification courses and register with a regulatory body.

Education

Advisors do typically have some sort of financial educational background, like a degree in finance, economics, business, or commerce. This isn’t a strict requirement, however. Each specialty or career path will come with a set of requirements like specific courses.

For starters, the Canadian Securities Course (CSC), offered by the Canadian Securities Institute (CSI), is the foundational requirement for most financial services careers. In fact, it’s a prerequisite to getting licensed to sell securities.

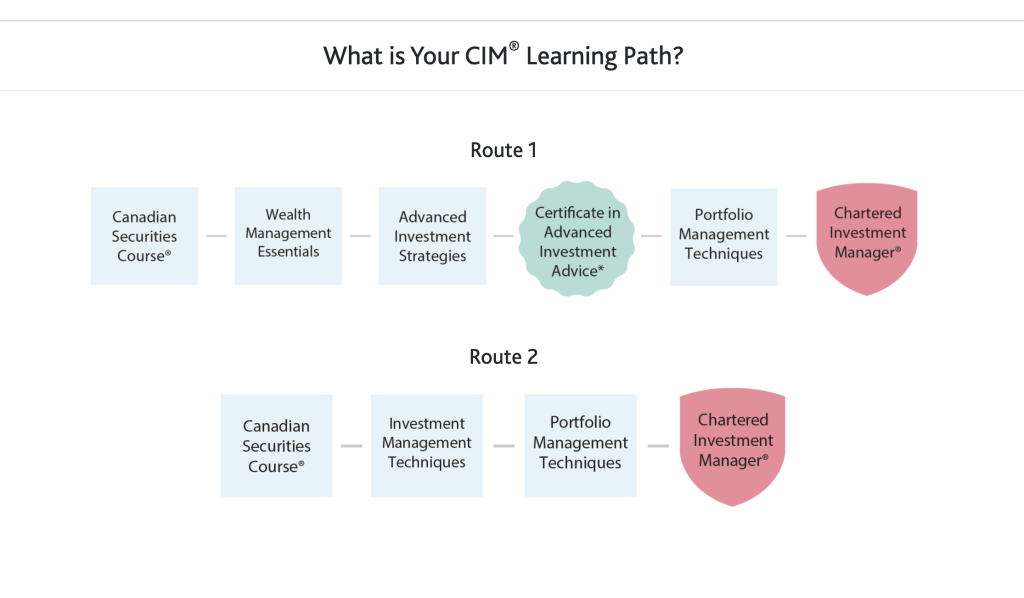

Most designations (i.e CFP, CIM, etc) have specific learning pathways or series of courses you must follow in order to qualify for a certification exam. For example, this chart shows the courses you need to take from the CSI in order to obtain a Chartered Investment Manager (CIM) designation:

Through the CSI, you can take over 270 industry-recognized courses and credentials, including the above CIM, Personal Financial Planner (PFP), Certified International Wealth Manager (CIWM), and MTI® Estate & Trust Professional.

Interested in pursuing a financial planning career? You’ll need to go through FP Canada. They offer pathways to both Qualified Associate Financial Planner (QAFP) and Certified Financial Planner (CFP) certification. You can also go through Advocis, an FP Canada-approved learning provider for both certifications.

Examinations, registration, and licensing

Once you’ve successfully fulfilled all coursework involved in the designation you’re pursuing, it’s time to write a final exam and apply for certification. For example, with the CFP designation, the final exam is six-hour and computer-based. It’s administered three times a year by FP Canada and is available in English and French. You’ll also need to make sure you have completed any work requirements before applying for certification.

If you’re going to be selling financial products or taking on a role like a portfolio manager, you’ll need to register with a regulatory body. The Investment Industry Regulatory Organization of Canada (IIROC) is the regulatory body for all securities firms in Canada. The Mutual Funds Dealer Association (MFDA) is formally recognized in Alberta, British Columbia, Nova Scotia, Ontario, Saskatchewan, New Brunswick and Manitoba as the body that sets requirements for mutual fund dealers. They also have a cooperative agreement allowing them to be a part of regulating the profession in Quebec.

Finally, as the CSI elaborates in their section on licensing, provincial securities commissions are the ultimate authority for licensing requirements.

Work experience

Many of these specific designations will require some degree of work experience — either before applying for a specific certification or as a requirement after coursework. For example, to become a Certified Financial Planner (CFP), you need three years of qualifying financial planning work experience at the time of applying for CFP certification.

As another example, to qualify for a Chartered Investment Manager (CIM) Designation, you need to have “at least two years of experience within the past five years involved in an investment management capacity that includes applying or supervising any aspect of the investment management process.”

How long does it take to become a financial advisor in Canada?

Becoming a financial advisor in Canada is sort of like creating your own specialty within a specialty.

Each designation or career path has a different set of requirements. It’s also important to note that specific courses or learning pathways could have set limits for how long you can take to complete the necessary requirements.

The Canadian Securities Course exam alone requires 100-200 hours of prep time. While it’s hard to say how long you’re looking at before you can market yourself as an advisor, you likely face more than a year of education — especially if you’re continuing to work your regular day job.

Working as a financial advisor in Canada

You’ve passed your final exams, received your certifications, and are starting to work in your chosen advisory role. Your next step is making sure you’re bringing in clients. A solid digital marketing strategy with relevant, good-quality content is a must! You might also choose to develop a niche practice to help your business stand out.

It’s also important to nurture your client base and leverage it to give your business a boost. Online meetings have been normalized in recent years. Make sure these conversations with clients are meaningful and productive.

Finally, if you have a sizeable client list, leveraging client feedback can help your business grow. Client reviews on social media and Advisorsavvy are a powerful form of marketing!