Are you aware of the importance of financial literacy and how this knowledge can be applied to manage your finances? Financial literacy is a powerful tool that everyone should be armed with, regardless of their current level of income or financial security. Knowledge about budgeting, savings, borrowing money and planning for retirement are all components of sound financial literacy skills. Being able to understand these concepts can make a huge difference in helping Canadians live debt-free and achieve their long term goals. In this blog post, we will explore what is financial literacy and why is it important as well as basic principles surrounding financial literacy in Canada. Continue reading to learn more!

Table of contents

What is the meaning of financial literacy?

Financial literacy is defined as the level of ability to understand and effectively apply financial knowledge and skills. Many define financial literacy as financial awareness, attitudes and behaviors related to decision making around money as well. This could include an array of personal finance competencies, such as budgeting, using and optimizing credit scores, investing, managing debt, and much more. The higher one’s financial literacy is, the more competent they are at managing money.

Match to your perfect advisor now.

Getting started is easy, fast and free.

The Government of Canada produced findings from the Canadian Financial Capability Survey in 2019. Here were some key statistics about financial literacy among Canadians:

- 73% of Canadians have outstanding debt or relied on payday loans; 31% believed they had too much debt

- 49% of Canadians use a budget, 20% of which use some kind of digital tool to aide their budgeting

- Canadians who had a budget were less likely to fall behind on financial obligations, 8% compared to 16%; those with budgets also had better cashflow (18% vs 29%) and were less likely to borrow money to meet day to day expenditures (31% vs 42%)

- 69% of Canadians are financially preparing for retirement independently or through an employer pension; those who have a retirement plan are more confident in the amount they need to save (56% vs 28%)

- 64% of Canadians have an emergency fund to cover up to 3 months worth of expenses

- Canadians seek financial advice and knowledge from multiple sources: financial advisor or planner (49%), banks (41%), friends and/or family (39%), and Internet research (33%)

- 55% of Canadians have a will and 40% have a power of attorney set up

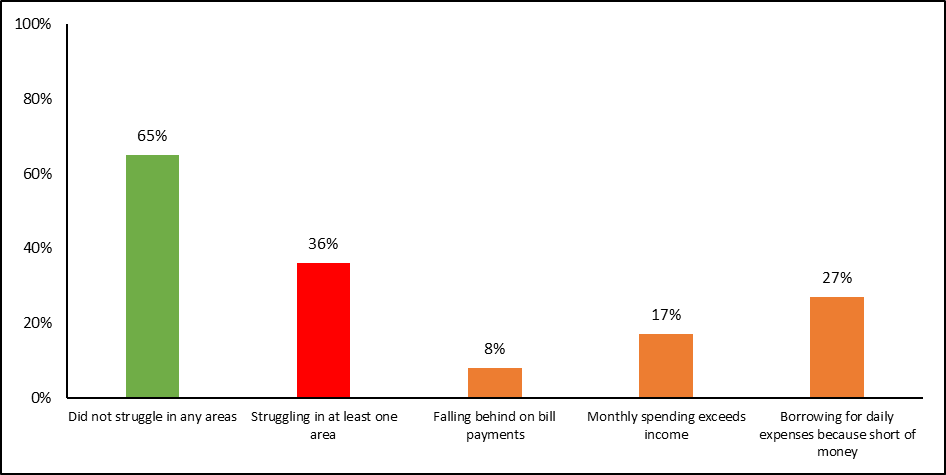

Lastly, below is a chart that represents the percentage of Canadians struggling to make bill payments or manage cash flow in a 12 month period. This chart is a good indicator of overall financial literacy in Canada:

Curious about what your financial literacy is relative to other Canadians? Take this self-assessment to determine your financial literacy rating!

Why is financial literacy important?

The more financially literate someone is, the better equipped they are to handle day-to-day finances, unexpected costs, and short and long term financial goals. In addition, greater financial literacy can lead to a healthier life from both a mental and physical perspective. It turns out there is a correlation between struggling with finances and mental health. By being more mindful about your finances, you can lead a more robust, flourishing life.

Ultimately, finances play a big part in our lives in Canada, especially with high inflation and soaring housing prices. Through greater financial literacy, you can gain more control over your spending, savings and overall lifestyle. Stable finances equates to a happier life!

What is the basic rule of financial literacy?

The basic rule of financial literacy is to apply knowledge and skills surrounding money in a way that aligns with your personal objectives. In other words, financial literacy involves a certain level of finesse and inner understanding. A particular financial approach might work for one person, but may be completely inappropriate for another. Throughout your financial journey, be sure to check in with yourself and what your financial goals are. Then, use your monetary knowledge and skills to get there.

What are the five principles of financial literacy?

Ready to continue your financial literacy journey? You’ve learned what is financial literacy and why is it important, it’s time to check out the basics. Here’s the five principles of financial literacy to get you started.

Earn

This component of financial literacy explores earning income. There are many facets of earning money, including diversifying types of income and developing skills to earn a higher income. Financial literacy surrounding earning could also include getting paid what you’re worth, understanding how and when to ask for a raise, or knowing when to switch jobs when there are more lucrative opportunities available.

Save & Invest

Saving and investing is another critical aspect of financial literacy. Saving is the first step and there are multiple purposes you might save towards. More specifically, money should be put aside for an emergency fund and saving for short term goals, such as a vacation or an education program. Saving for long term goals is also important which could include buying a home or retiring.

Once you have built up some savings, the next step is investing your funds. Investing involves a greater degree of financial literacy because you should ensure your investments appreciate over time. There is also an art to knowing when to buy and sell investments based on the market and your personal circumstances.

Protect

With more wealth comes more risk and responsibility! For this reason, protecting the wealth you acquire through insurance is another aspect of financial literacy. Obtaining adequate and complete insurance for your home, car, and other property can prevent headaches if something were to happen to your belongings. You might also consider life insurance if loved ones rely on you for financial support.

Spend

Keeping spending under control while still having funds available to enjoy your lifestyle is a balancing act. Financial literacy in this category surrounds creating and following a budget, and keeping up with bill payments and other financial obligations.

The spending principle of financial literacy also focuses on credit scores which reflects your creditworthiness. Paying attention to your credit score is important because it can determine your ability to get approved for financing down the road. In addition, keeping an eye on your credit report can be a great way to catch fraud or identity theft.

Lastly, spending also includes taxation. Every Canadian has to file a personal tax return every year, sometimes other tax returns depending on their circumstances. As you go deeper into your personal finance journey, you may run into greater taxation, such as capital gains tax or moving up in tax brackets. Taking the time to understand the Canadian tax system and how it affects you will allow you to tax plan.

Borrow

Borrowing is the final component of financial literacy. While debt is often seen as bad, it can actually be a very helpful tool when used correctly. Unfortunately, many Canadians may over leverage themselves by taking on too much debt.

The reason for borrowing is often the key to whether or not debt is being used well. If you’re utilizing debt to purchase something that will build wealth or generate income, like a home or rental property, then it’s probably a good idea. But if you’re using it to purchase things that won’t improve your financial situation, such as going on a vacation or buying material goods, then you’re likely taking on unnecessary debt.

How do I educate myself financially?

Now that you understand what is financial literacy and why is it important, you can continue learning on your own. Fortunately, there is no shortage of financial resources in Canada. However you learn best, there is likely a tool to help you accelerate your financial literacy. Here are some resources we can provide:

- 15 Best Finance Podcasts Canada

- 10 Best Finance TV Shows and Films

- Best Investing Books For Canadian Investors

Ready to keep learning? Check out this next: When to Teach Kids About Money