Retirement is something people work their whole lives towards, literally! However, it’s often a mere concept to most people until the big day approaches. Sure, you’ve been saving a portion of your pay cheque for years, but what about all the other aspects of retirement preparation? You have to consider what your lifestyle will look like, where you’ll live, and what you’ll be doing with your newly free time. If you’re feeling overwhelmed, don’t worry, we’ve got you covered with this retirement checklist for Canada! Keep reading to learn more about retirement in Canada and how you can best prepare yourself.

Table of contents

- What do you need to retire in Canada?

- Retirement Checklist Canada

- 1. Create a Financial Plan

- 2. Set a Retirement Date

- 3. Apply for Government Benefits

- 4. Consider the Impact of Continuing to Work

- 5. Review and Update Insurance Coverage

- 6. Consider Tax Deductions and Credits

- 7. Get into Couponing and Senior Discounts

- 8. Pension Splitting

- 9. Protect Yourself from Fraud and Financial Abuse

- 10. Hobbies and Activities

- Planning for Retirement in Canada

What do you need to retire in Canada?

The main thing most people need to retire is a nest egg. Most people save within an RRSP, TFSA and non-registered investment accounts. But how much money do you need to retire, exactly? The answer depends on various factors, such as your desired lifestyle and anticipated expenses. In addition, you should consider your post-tax retirement savings to ensure you can live comfortably. If you’re unsure how to estimate your retirement savings goal, consider using a retirement calculator or consulting a financial advisor.

Another important aspect to consider is your budget in retirement. Chances are, it will change from your current budget while you’re working. For instance, you won’t need a big budget for commuting to work anymore, but you might have a bigger budget for traveling. As a part of your preparation for retirement, you should create a budget for your new lifestyle. This will help you transition and adjust.

Match to your perfect advisor now.

Getting started is easy, fast and free.

Related Reading: The 4 Phases of Saving for Retirement in Canada

How much money does the average Canadian retire with?

According to Statistics Canada, the average net worth of Canadians at retirement age is $543,200. This means retirees typically have just over half a million dollars to live off of in retirement.

However, keep in mind this is net worth which isn’t the same as savings. It is the total value of assets less outstanding debts. Although, retired individuals often have already eliminated their debt during their lifetime, such as a mortgage. For this reason, much of that figure would represent cash and investments.

Furthermore, this figure is a national average. The number might be higher if you intend to retire in metropolitan areas, like Toronto or Vancouver. On the contrary, it might be lower if you choose to retire in a more rural area where the cost of living is lower. As we said before, the savings goal you set for yourself depends on many factors. The number you need to reach to retire is personalized.

Related Reading: Average Retirement Age in Canada

Which is the biggest expense for most retirees?

The biggest expense for most retirees is housing. This includes things like mortgage payments (if you haven’t paid off your balance before retirement), rent, property tax, home insurance, tenant insurance, repairs and maintenance, and utilities.

In order to save money in retirement, many choose to relocate since they no longer need to be in a certain region for work. Not only does moving to a new place to retire save money, it can also elevate your lifestyle. For example, instead of living in a big city, you can live near nature and enjoy daily hikes and other outdoor activities, if that’s your thing.

Related Reading: Average Canadian Savings by Age

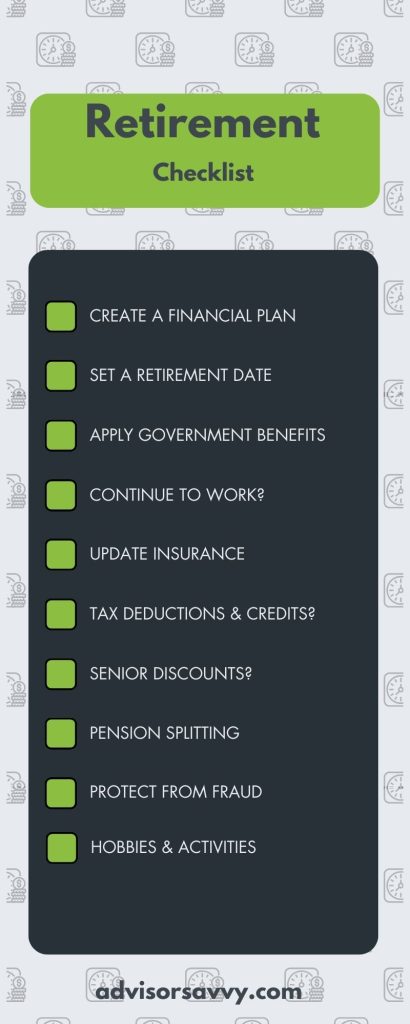

Retirement Checklist Canada

Up until now, we’ve mainly discussed the financial component of retirement. Below is a complete retirement checklist for Canadians who are approaching retirement. In addition, the Canadian government has a helpful tool to determine whether you’re ready to retire yet.

1. Create a Financial Plan

As mentioned above, you should have a financial plan on how you will support yourself in retirement. The first thing to consider is government programs like the Canada Pension Plan (CPP), Old Age Security (OAS) and Guaranteed Income Supplement (GIS). These programs provide income to seniors and retirees, but most need additional savings or income to live comfortably in retirement. Often, this means relying on savings built throughout your lifetime. Some save independently without a pension and others have a pension plan. If you don’t have enough savings, some retirees work part-time, freelance or contract to bring in more income.

One side of your financial plan is income and savings, and the other is expenses and budgeting. Your lifestyle will change in retirement and so will your expenditures. Before you retire, you should create a revised budget so you can anticipate changes during the transition. In addition, you should forecast your expenses so your cash flow isn’t affected. All in all, a financial plan is crucial for preparing for retirement.

Related Reading: Tax Efficient Retirement Withdrawal Strategies in Canada

2. Set a Retirement Date

As a part of your retirement planning, you should estimate your date of retirement. Sometimes you might set a date then work backwards. Other times you’ll determine an estimated date based on how much you’re saving per year and when you’ll reach that target. No matter how you do it, there should be a general time frame which you expect to retire.

3. Apply for Government Benefits

Once you know your retirement date, you should apply for government benefits ahead of this date. This way, you’ll be receiving your CPP, OAS and GIS payments right when you retire. Otherwise, you might have a gap in your income which isn’t the best way to start off your golden years!

Related Reading: CPP vs OAS: What are the differences?

4. Consider the Impact of Continuing to Work

If you choose to continue to work beyond retirement, such as on a part-time, freelance or contract basis, it may impact your eligibility for government benefits or payout from pensions. Some need to work to bring in more income and others choose to work to stay busy. Be sure to consider the impact of continuing to earn an income in retirement before moving forward with some sort of employment in retirement.

5. Review and Update Insurance Coverage

Anytime your lifestyle changes, it’s a good idea to review and update your insurance. In retirement, you may have a greater need for travel insurance. Or maybe you need to update your life insurance policy. Going through this exercise will help you protect your finances in the worst case scenario. This is especially important since you are no longer earning employment income and are relying heavily on savings.

6. Consider Tax Deductions and Credits

One of the silver linings of retirement and older age is more tax benefits! During tax season, it’s good practice to review new deductions and credits you are now eligible for. A few common ones that come up are deductions for medical expenses and claiming the age amount.

Related Reading: Estate Planning Checklist for Canadians

7. Get into Couponing and Senior Discounts

In addition to more tax credits and deductions, seniors can access special promotions. You can get senior discounts on groceries, clothes, experiences and more. It’s wise to familiarize yourself with discounts at stores you frequent so you can keep your living costs low.

8. Pension Splitting

In Canada, you are allowed to income split pensions with a spouse or common law partner. This allows you to pay cumulatively less tax as a household. Consider pension splitting and whether it’s right for you in retirement to save money on taxes.

9. Protect Yourself from Fraud and Financial Abuse

Unfortunately, seniors in Canada are often a target of fraud and financial abuse because they are vulnerable. Part of your retirement plan should be protecting yourself from potential financial loss and exploitation. One way to prepare yourself for this risk is to set up a power of attorney, appoint an executor and prepare a will.

Related Reading: Executor of Will vs Power of Attorney: What’s the Difference?

10. Hobbies and Activities

During the working years, people dream of retirement and having nothing to do. While it might be nice to decompress from your working days for a little while, you may eventually get bored and want to find something to fill your free time. Consider what hobbies and activities you’d like to participate in during retirement and what it may cost you. Travel is a big one, for instance, but it’s not cheap! You can also consider other endeavors like joining a reading circle, volunteering, and crafting.

Related Reading: 20 Things to Do in Retirement

Planning for Retirement in Canada

Retirement is an exciting time in your life! While the planning and preparation aspect from this retirement checklist for Canada can be overwhelming, remember why you’re doing it and the rewards you’ll reap when it’s all said and done. And if you ever need help along the way? Consider consulting with a financial advisor who can help you navigate the complexities of preparing for retirement. Complete this quick questionnaire to get matched with one today!

Read More: Your Year-End Financial Checklist: 6 Actions for You to Take