Nothing in life is certain. This is why estate planning and preparing for the worst is a necessary exercise to protect your wealth. During the process, you might come across the terms executor of will vs power of attorney.

You might be wondering, who executes your will once you pass? And what happens if you become incapacitated before death and can’t act in your best interest? We know; it’s a gloomy, uncomfortable subject. But still, making advanced arrangements for handling your personal and financial affairs is paramount.

Enter the executor of the will and power of attorney (POA) — two legal entities that bring peace of mind. While they have varying duties and come into play at different times, they both make decisions on our behalf when we are otherwise unable to.

Table of contents

- What is the difference between an executor and power of attorney in Canada?

- Does an executor have more power than a power of attorney?

- How to Appoint Executor of Will vs Power of Attorney

- Can the executor of a will take everything in Canada?

- Does power of attorney override a will?

- Should power of attorney and executor be the same person?

Are you assisting a family member in getting their affairs in order? Or maybe you want to proactively protect your future. Let’s go over the differences between the executor of will vs power of attorney so you can make informed decisions.

What is the difference between an executor and power of attorney in Canada?

In Canada, an executor is someone you appoint to carry out your will after you pass away. They’ll take care of filing your final return, repaying debts, closing active accounts, and, most importantly? Distributing your assets to beneficiaries.

Now, shouldn’t your will speak for itself? Why select an executor to begin with? It’s true, a will is a legally binding document. If you don’t have an executor for your will upon death, the court assigns a government representative executor. Sure, they’ll be required to follow your will as it’s written. But they won’t have intimate details about the manner in which you’d like your wishes to be executed, nor will they have your family’s best interest at heart.

A power of attorney is a legal document that gives someone the authority to act on another person’s behalf while they’re still alive, who’s known as the donor. POA can be enacted in a number of situations, such as if someone becomes mentally incapable or has to deal with a demanding emergency. A power of attorney’s specific duties are explicitly described in the document but might include regular banking tasks, borrowing money, handling property, or signing cheques.

In summary, the main difference between executor of will vs power of attorney is that a power of attorney acts on your behalf while you’re alive yet incapable. Whereas an executor acts on your behalf once you’re dead.

Related Reading: Best Monthly Dividend Stocks in Canada for 2022

Does an executor have more power than a power of attorney?

Neither has more power than the other, rather they possess different kinds of power. Some might perceive a power of attorney as having greater authority over an executor because they have to use discretion in their role which is subjective. Whereas with an executor, they must follow what’s written in a will.

Truthfully, the roles of executor and power of attorney creates an opportunity for abuse of power. While there is a chance that someone in either role could abuse their power, they are bound by the law. We can only hope justice is served if someone takes advantage of their role as an executor or power of attorney.

To better understand the legal responsibilities, let’s explore specific duties for an executor of will vs power of attorney.

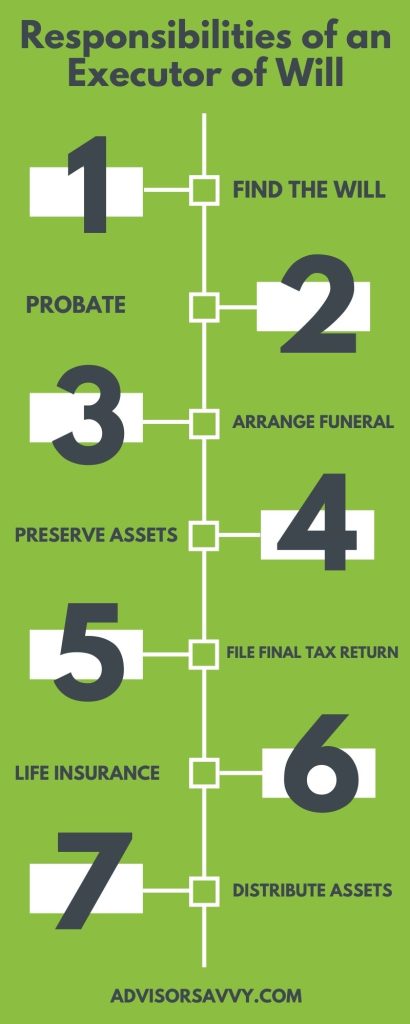

Responsibilities of an Executor of Will

Below are the legal responsibilities of an executor. As mentioned, executors are bound by the law. It is illegal for someone in this role to exploit the situation for personal gain.

Find the will

An executor is responsible for locating the last will and testament of the deceased. If the executor was appointed by the deceased before death, chances are they know where the will is. Otherwise, the executor might have to do some light detective work to find it!

Once the will is found, the executor should do a preliminary review to begin planning for the overall process. For instance, executors must determine the will’s complexity, noting any areas where they’ll need reinforcements (such as legal expertise for tricky clauses).

What if there is no will? In this case, an executor will still oversee the process. But instead of following the deceased’s wishes, the estate will be handled according to provincial or territorial law.

Probate

Probate is the legal process where a will is verified and an executor is officially appointed. An executor is responsible for starting the process and setting the court date.

Arrange the funeral

An executor is responsible for arranging the funeral with guidance from the deceased’s family and friends, if appropriate. Executors must obtain a death certificate during this process. This is the legal document that officially verifies someone’s death.

Preserve assets of the estate

The executor must take inventory of the estate’s assets and safeguard them until they can be distributed. In the interim, an executor would also manage the estate, such as making sure bills for a property are paid. Remember, the executor cannot legally access or use assets in the estate for their own personal gain.

File final return, pay taxes and settle debts

The final tax return for the deceased is completed and filed by the executor. If any taxes are owed, those must be processed by the executor.

If any other debts outside of tax are outstanding, the executor must deal with that too. This includes communicating with creditors and settling debts where appropriate.

Life insurance

The deceased could have a life insurance policy. If so, it’s up to the executor to inquire and facilitate a payout.

Distribute assets

The executor is responsible for distributing the assets based on what’s written in the will. This is normally the final component of an executor’s duties.

Other responsibilities

Here’s a few other responsibilities executors may have to carry out:

- Arrange guardianship for minor children

- Provide records of accounting in relation to activities of the estate after the death of the owner

- Communicate with the deceased’s spouse or common-law partner

- Perform enforceable contracts against the estate

Remuneration for Executors of Will

In Canada, an executor of a will — whether a friend, family member, or professional — is legally entitled to compensation and reimbursement of expenses incurred. After all, there is a lot of work involved with being an executor. The rule of thumb is 5% of the estate value. If compensation isn’t listed on the will, the executor must send an account of expenses to the beneficiaries and determine a fee. This helps to avoid disputes or lack of funds later on.

Related Reading: Estate Taxes in Canada

Responsibilities of Power of Attorney

Power of attorney duties can vary widely based on what’s specifically stated in the legal document. A donor is the individual who gives you power of attorney. Here’s a list of common power of attorney responsibilities which are done on behalf of the donor:

- Manage day to day banking

- Sign cheques

- Buy or sell real estate

- Borrow money

Power of attorney only lasts as long as the donor is alive. During this time, the POA cannot make a will, change their existing will, change named beneficiaries in life insurance policies or other savings plans, or delegate responsibility to someone else. All in all, the power of attorney is responsible for acting in the best interest of the donor. They must also keep adequate records of the financial activity.

Types of Powers of Attorney in Canada

Canada has three types of POAs, as described below:

- General Power of Attorney: A general power of attorney can mean restricted or complete authority over someone’s affairs for a limited or continuous period. This responsibility includes managing the donor’s finances, making business decisions, and conducting real estate transactions. A general power of attorney might also be authorized to validate or nullify contracts and make legal claims or settlements. This is the ideal POA to manage your affairs temporarily, like if you’re on a trip or dealing with an emergency overseas.

- Power of Attorney for Personal Care: A loved one with exceptional decision-making ability is usually given the power of attorney for personal care. A document outlining your wishes in scenarios related to medical issues, health, food, or housing authorizes the agent to make decisions if there comes a time when you can’t express them.

- Power of Attorney for Property: This POA manages anything considered your property, including your real estate holdings, heirlooms, furniture, cars, and other finances. They might even be responsible for managing your business.

Since POA duties vary so greatly, the timeframe is similarly varied. The POA’s responsibilities end when revoked by the donor, the predetermined task or time has been completed, or when the donor dies.

Remuneration for Power of Attorney

Like executors, there is a great deal of work involved with being a power of attorney. They are entitled to some compensation, but the specifics depend on the province or territory which you reside. Since the duties of a POA can vary greatly, the fee can vary as well. However, it’s usually a percentage of income, disbursements or estate value.

How to Appoint Executor of Will vs Power of Attorney

Ready to appoint an executor or power of attorney? Learn how to choose the best person for the job below.

How to Appoint an Executor of Will

The executor is usually named in a person’s will. In fact, the executor is often aware before the person’s death that they’re the executor. Because of the personal nature of death and executing a will, it’s best to choose someone specific during your estate planning. You could choose a trusted family member or a professional you trust, such as your lawyer or financial advisor.

Keep in mind that the role of an executor comes with tons of responsibilities, as we saw above. They have lots of paperwork and financial records to orchestrate, along with the psychological burden of dealing with the drama of death. It’s best to consider these factors when choosing an executor. Here’s some pro tips for appointing an executor in your will:

- Ask for permission: Before naming someone as executor in your will, ask the person for permission. It’s a big responsibility so it’s not fair to assume the individual is willing.

- Consider skillsets: Do you have an accountant or lawyer in your family? Or maybe a financial advisor or wealth manager you have worked with for years? These people have the appropriate skills to handle executor duties. Definitely consider people with the appropriate skillsets before others.

- Age: Choose an executor who’s younger than you. Otherwise you might run into complications if your executor passes away before you do.

- Trust: You should trust your executor because you’re handing them your estate when you pass. In addition, it’s best if you can talk to your executor about your wishes before you die — this is difficult to do without trust.

How to Appoint a Power of Attorney

You can appoint a power of attorney when you’re as young as 18. POA is very broad and can apply in an array of circumstances. It’s best to pick someone you trust and possesses the necessary skills to complete the required duties.

Once you’ve decided on a candidate, you can seal the deal with a lawyer and have both parties sign with a witness. Certain Canadian provinces have additional rules at this stage. For example, in British Columbia, the agent listed as the attorney has to submit a record stating their awareness and consent for the POA. Don’t forget to make some certified copies and inform your POA where the original is stored.

Related Reading: 5 Best Green Energy Stocks in Canada

Can the executor of a will take everything in Canada?

No. Thanks to strict Canadian laws safeguarding the estate owner, an executor of a will cannot misuse their position of power. The executor has to perform their job in a timely, legal order, keeping the estate and beneficiaries’ interests at the forefront. Otherwise, they will face harsh consequences and be held for damages.

An executor can neither create nor modify the will. They cannot add or remove any beneficiaries unless specified in the will. You can rest easy knowing that your estate is protected by the law!

Does power of attorney override a will?

A power of attorney does not override a will. In fact, a power of attorney cannot legally write a will or change an existing will on behalf of the donor. In addition, power of attorney ends when the donor passes away. At that point, the will comes into effect and the POA dissolves.

Should power of attorney and executor be the same person?

Before answering this, can a power of attorney and an executor be the same person? The answer is yes. There is no law that permits someone from being both your power of attorney and executor. So, you don’t have to make a decision between executor of will vs power of attorney! Whether it should be the same person is a personal choice. Often, it can make things easier to have the same person act as the executor and power of attorney, but it really depends on you and your circumstances.

Need help appointing an executor or power of attorney? We can help! Complete this quick questionnaire to be matched with a financial advisor.