Variable vs fixed mortgage? That is the question!

You will most likely have to answer this question before signing off on a property and obtaining a mortgage. Deciding between both options is one of the biggest dilemmas you will face when purchasing a home. This is because the decision you make now will affect you for years to come. It may also mean the difference between paying thousands of dollars in interest, or not. But, when comparing both, your deciding factors will typically boil down to two things. These are the cost and predictability of the mortgage and other economic factors.

Table of contents

Whether you’re a first-time buyer or refinancing, we’ve got you covered with this article. Understanding the difference between variable vs fixed mortgages is vital for your financial future. Below, we explore their differences to help you make an informed decision. Keep reading to learn more!

Related Reading: How to Switch Financial Advisors

Variable vs Fixed Mortgage: What is the difference?

Let’s look at the main difference between a variable vs fixed mortgage. With one, you always know where you stand, unlike the other. A fixed mortgage has set payments and a fixed interest rate for the entire term. But with a variable mortgage, the interest rate fluctuates based on your bank’s prime rate.

Let’s consider each of these mortgage types one after the other to understand them better below.

What is a variable rate mortgage?

With this type of mortgage, your interest rate rises and falls in response to the bank’s prime rate. Prime rate is defined as the interest rate a commercial bank charges its best customers. The use of the term ‘best’ simply means that these are the bank’s most creditworthy customers. Normally, a variable rate mortgage is expressed as the bank’s prime rate, plus a set rate. So, if the prime rate rises or falls, the same will happen to your variable mortgage rate.

But this type of mortgage facility has smaller penalties. Let’s say you break your mortgage contract halfway through the term. You will pay less compared to when you break a fixed mortgage, in most cases.

What is a fixed rate mortgage?

This is the most popular mortgage loan option you will find in Canada. Although not the cheapest option, people prefer it because of the stability it offers. Many borrowers are willing to pay a couple more dollars extra for the predictability that comes with a fixed rate mortgage.

But how does a fixed-rate mortgage work? Simple! With this type of mortgage, you pay the same interest rate throughout the term. In other words, your mortgage may be for six months, five years, or even longer. Regardless of the term length, your mortgage payment will remain the same each period because the interest rate is locked in.

Related Reading: Mistakes To Avoid When Paying Off Your Mortgage Early In Canada

Your credit score & report. Always free, forever

It takes 3 minutes to join 20+ million people who trust ClearScore to help them improve their financial future

Pros and Cons of Variable vs Fixed Mortgage

In this section, we will draw out some of the advantages and disadvantages of variable vs fixed mortgage options. To start, let’s look at how variable mortgages perform.

Pros and Cons of a Variable Mortgage

| Aspect | Pros | Cons |

| Interest Rate | Initial interest is typically lower. | This type of mortgage is subject to market fluctuations. So, rates can go up anytime. |

| Rate Stability | There is potential for lower overall interest costs if prime rates remain low. | Most times, rates are never stable. As a result, there is too uncertainty associated with this option. |

| Risk Tolerance | Suitable investment for persons who have higher appetite for risk. | The risk of a rate hike can be stressful, thereby discouraging this investment. |

| Penalties | There are lower penalties when you break this type of mortgage. | The chance of rates going up can cannibalize savings on penalties. |

| Affordability | Since it has lower rates, you may pay lower monthly payments. | Whenever rates go up, you will pay higher interest than any other mortgage. |

| Suitability | This is a good option for high-risk investors. | Variable mortgage is bad for people on a tight budget. |

Now, let us consider how a fixed mortgage performs in comparison.

Pros and Cons of a Fixed Mortgage

| Aspect | Pros | Cons |

| Interest Rate | The interest rate on a fixed mortgage is constant. You can predict the outcome and budget better. | Initial interest rates are often higher than the market average. |

| Rate Stability | Throughout the mortgage term, the rate is stable. | Sometimes, interest rates drop after you get a fixed-rate mortgage. The implication is that you may pay more overall interest compared to variable interest. |

| Risk Tolerance | This option is ideal for people who don’t like taking risks. | Failing to take a calculated risk with your finances can result in greater expenditure on interest costs. |

| Penalties | Not all fixed mortgages attract pre-payment penalties. | You pay higher penalties if you break the mortgage. |

| Affordability | With predictable payments, you can leverage your income to afford a mortgage. | Initial higher costs may strain your budget. |

| Suitability | This option is suitable for people who want consistent payments. | You may miss out on potential rate savings. |

Related Reading: How to Fix RRSP Over-Contributions

What percentage of mortgages are variable vs fixed?

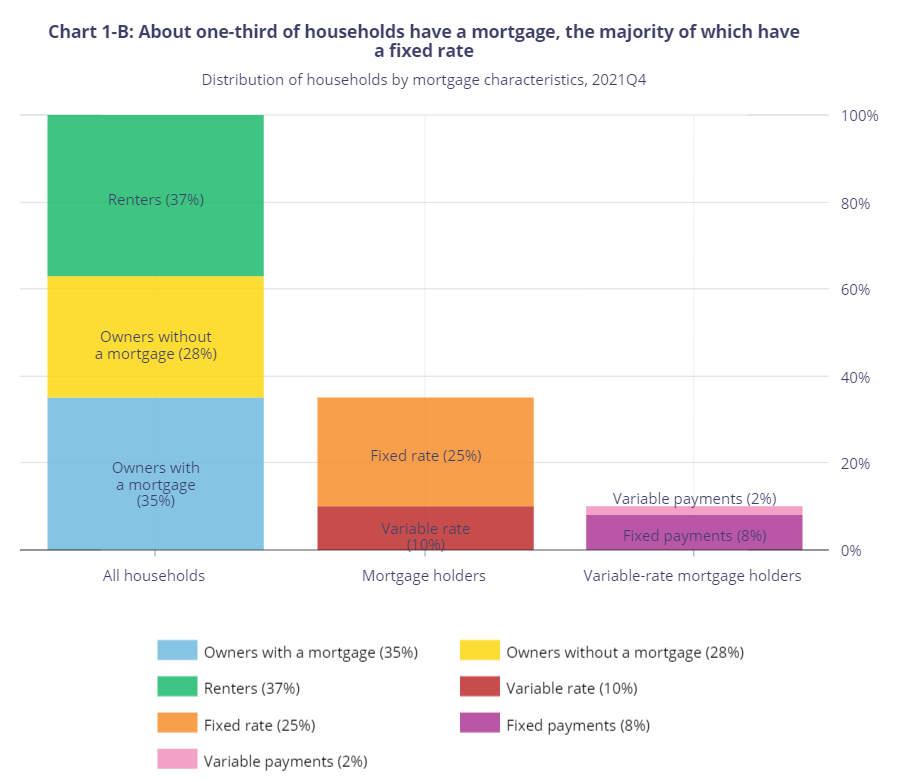

The Financial System Review conducted by the Bank of Canada reveals that about one third (35%) of Canadians have a mortgage, as of the end of 2021. Of that figure, more people have a fixed mortgage, as opposed to variable. About 25% of Canadians have a fixed rate mortgage and 10% have a variable rate mortgage.

Will mortgage rates go down in 2023 Canada?

A variety of factors influence mortgage rates. These include the Bank of Canada’s prime rate decisions and economic conditions. Global trends are determining factors as well since the international economy is interconnected. Thus, Canadians typically make their mortgage decisions around these forecasts.

In January 2023, the central bank put a pause on the increase of its prime interest rate, but this decision was conditional. It was made depending on economic performance and whether inflation would decline. As we entered March and April 2023, the economy and inflation signs were not positive, unfortunately.

This forced the central bank to review its stance. Currently, there is a market consensus for the prime rate to stay at 5%. But there are chances of another rate hike in October 2023 if the situation does not improve. Some major Canadian banks have even forecasted a recession in late 2023. Data supports this prediction, as there has been no real GDP growth since 2018. In fact, some indicate that GDP growth is in the negative which is a tell-tale sign of recession conditions, possibly even a depression.

So far, it has been almost two years since the last rate hike. Experts predict a mortgage rate drop in Q3 of 2024. For now, nothing indicates that mortgage rates will drop in Canada for the rest of 2023.

Your credit score & report. Always free, forever

It takes 3 minutes to join 20+ million people who trust ClearScore to help them improve their financial future

Instead, things may remain at 5% or increase to 5.2% as the 2023 year draws to a close. Nesto anticipates that the Bank of Canada may raise rates by 25% this September. This will bring the figures to 5.25%, as we mentioned earlier.

Plus, the US federal interest rate is another determining factor to look out for. The Canadian and American economies are closely connected so what happens on one side of the border often heavily influences the other side. Suppose they increase rates during any of their next scheduled meetings. In that case, the Bank of Canada will be forced to increase its rate. That way, we can avoid a situation where the Canadian dollar will face devaluation.

Related Reading: How to Fix TFSA Over-Contributions

Should I switch from variable to fixed mortgage in Canada?

In this article, we have already established that fixed mortgages are more popular among property buyers in Canada. Yet, since 2021, variable mortgages have seen lower interest rates than fixed mortgages. This has caused the variable mortgage to become more popular in such a short time.

Data shows that more than 50% of new mortgages and renewals are variable mortgages. Even the Bank of Canada revealed that variable mortgages composed of a third of mortgage debt in late 2021. For context, the figures were only about 20% in 2019, so there’s been a roughly 10% to 15% increase since.

Given what you know now, should you switch from one to the other? Here’s what we think. Moving from a variable to a fixed mortgage in Canada depends on several factors. These are mainly your financial situation, risk tolerance, and market conditions around you.

Generally speaking, when market conditions are volatile, as they are now, it is usually better to have a fixed rate mortgage. This is because you’re sheltered from unexpected rate hikes which can significantly increase your payment. There is greater stability and predictability with a fixed rate mortgage. But on the other hand, if you suspect that the prime rate will remain low as a result of economic activity around you, a variable mortgage can be a better choice. Since the prime rate was so low between the years of 2020 and 2022, variable rate mortgage holders saved on interest. However, they are likely paying more now due to rate hikes that occurred in mid-2022 and after.

Be sure to evaluate the factors that impact your finances before making a mortgage switch. Also, refinancing is expensive, so sometimes its better to wait until the end of your term before switching between variable vs fixed mortgages. Further, you can consult with a financial advisor before making a decision. These experts will first assess your situation then they will help you decide if switching will fit your specific circumstances.

Is it better to do fixed or variable mortgage?

Choosing between a variable vs fixed mortgage often depends on current economic conditions. In volatile times, opting for a fixed mortgage provides stability and peace of mind. This ensures that your interest rate remains constant and you won’t have to drastically revise your budget unexpectedly. On the flip side, a variable mortgage is better in periods of economic stability. This is because it can offer potential cost savings due to lower, consistent prime rates. Ultimately, your decision should be tailored to the specific economic climate and unique personal goals.

Read More: How to Improve Your Credit Score in Canada