Can you hire someone to invest for you? You sure can! There is, however, a cost for this kind of service, better known as investment management fees. Before paying for financial advice, it’s helpful to understand how these investment costs work. By the end of this guide, you’ll have an understanding of how to approach investment management fees in Canada.

Table of contents

What are investment fees?

Investment fees are the costs incurred when using financial products. Sometimes this could be financial advisor fees or it could be costs to use an online platform. In addition, there are many kinds of investment fees, such as broker fees, trading fees, and commission fees.

Normally, reasonable investment fees are incurred to turn a profit on the use of financial products. For this reason, considering fee structures is an important step in any investment decision. Otherwise, the fees you pay may cut into your profits significantly. But remember: fees aren’t the only aspect to consider when making an investment decision.

Match to your perfect advisor now.

Getting started is easy, fast and free.

What fees do you pay when investing?

Investment fees can vary greatly depending on the financial product and provider. Below is a summary of fees you can expect to come across in your investment journey.

Common types of fees

- Management fees: If you’ve hired a portfolio manager or robo-advisor, a management fee usually applies. This fee is the cost of the entity managing your financial portfolio. Typically, the fee is a percentage of the portfolio’s total value, though you’ll negotiate this at the beginning of a working relationship.

- Brokerage commissions: The amount charged by a brokerage per transaction based on purchasing and selling stocks and bonds.

- Discount broker fees and other charges: The services offered by discount brokers vary greatly. The service you’re using will impact the cost. In general, the charge is a simple amount per trade. However, there could be additional costs depending on the number of trades, size, and scope.

- Fees for services: Some financial services are fee-only. The advisor will charge a set rate and commissions are not applicable.

Related Reading: Commission Fees in Canada: A Complete Guide

How are investment management fees calculated?

The calculation of investment management fees varies based on the provider and service you’re using. Sometimes it’s a percentage of the entire portfolio under management. Other times, the cost is based on the transaction amount and frequency. In some cases, investment management fees could be a flat rate.

Because investment management fees vary so much, it’s important to read the fine print. When you understand the fee structure, you will be able to make a better decision for your investment portfolio.

What is a management expense ratio (MER)?

The management expense ratio (MER) is associated with mutual funds and exchange-traded funds (ETFs). Mutual funds and ETFs have their own operating expenses, such as legal, accounting, and management costs. The MER fee is the sum of all expenses, expressed as a percentage of the fund’s total value.

You should be able to find a specific ETF annual fees or mutual fund’s management ratio on their website or published somewhere publicly. You are responsible for paying the MER based on your specific investment.

Let’s look at a quick cost-of-funds example. If you have $10,000 invested in a fund and the MER is 2%, you would pay $200 ($10,000 x 2%) each year in MER fees.

We should note that Canada has some of the highest MER fees among developed countries. The costs can be as high as 2.5%. Fortunately, with technological advancements such as robo-advisors and online discount brokerages, there are ways of cutting some of these fees. A good benchmark for a MER is 1% or less.

Related Reading: How to Invest in Mutual Funds in Canada

Management fee vs. management expense ratio

There is a subtle difference between management fees and management expense ratio. Management fees are the operating costs of the investments — often referred to as maintenance fees. On the other hand, an expense ratio encompasses the management fees and operational fees per transaction, expressed as a percentage of the total fund’s value.

The difference between management fees and an annual expense ratio is slippery. As an investor, it’s important to take the time to understand how a particular investment management firm calculates its costs. This can help you avoid unexpected fees.

Can I deduct investment fees from my taxes?

In most cases, no, you cannot claim investment fees on your taxes. There is no investment expense deduction in Canada. This is because investment income is different from employment or business income. Since it is earned passively, not actively, deducting expenses against the income is not allowed.

The only exception would be if you’re a full-time day or swing trader. In this case, income earned from your investments is considered active business income. Expenses incurred to earn your income would be tax-deductible, including investment fees. However, you likely wouldn’t be employing an investment management company to manage your portfolio in this case. For this reason, your expense deductions may be nominal.

Keep in mind that investment fees incurred in a TFSA, RRSP, or other registered account are never deductible. The CRA designed these accounts for long-term investing, not active trading. For this reason, you are not allowed to treat income earned in these accounts as business income, regardless of the circumstances.

Related Reading: Are financial advisor fees tax deductible in Canada?

What is a good management fee for a mutual fund?

In Canada, the average equity mutual fund management fee is 2.23% ($2,230 per $100,000 of investments). It is widely known that Canada’s mutual fund fees are high for a developed country. To give you an idea of the cost disparity, the average MER in the United States is 0.66% ($660 per $100,000 of investments).

As mentioned above, cheaper options are becoming available in Canada as financial technology advances. Robo-advisors and self-directed investing platforms tend to have much cheaper investment management fees. The drawback? More self-directed learning and decision-making. But if you’re focused on growing your nest egg, this might make sense for you and be a reasonable trade-off.

Investment management fees in Canada

Portfolio managers often argue that investing with them is a long-term game. Furthermore, many Canadians perceive the high investment management fees as “high-value.” In actuality, high fees do not necessarily equate to quality investment strategies.

Many Canadians may jeopardize their long-term investments due to high investment management fees and a lack of financial knowledge. What’s worse is most Canadians are simply unaware of the impact investment management fees have on their nest egg. Most blindly choose an investment manager to work with hoping it all pans out in the end. The strategy employed by Canadians is usually “invest it and forget it.” This is especially true among younger generations.

With a bit of self-directed education, these issues can improve. But the reality is most Canadians are simply unaware of the problem and don’t see a need to find a better solution. Investing in your future is important. Even though it can be a pain to navigate all of these issues, you’ll thank yourself in the long run!

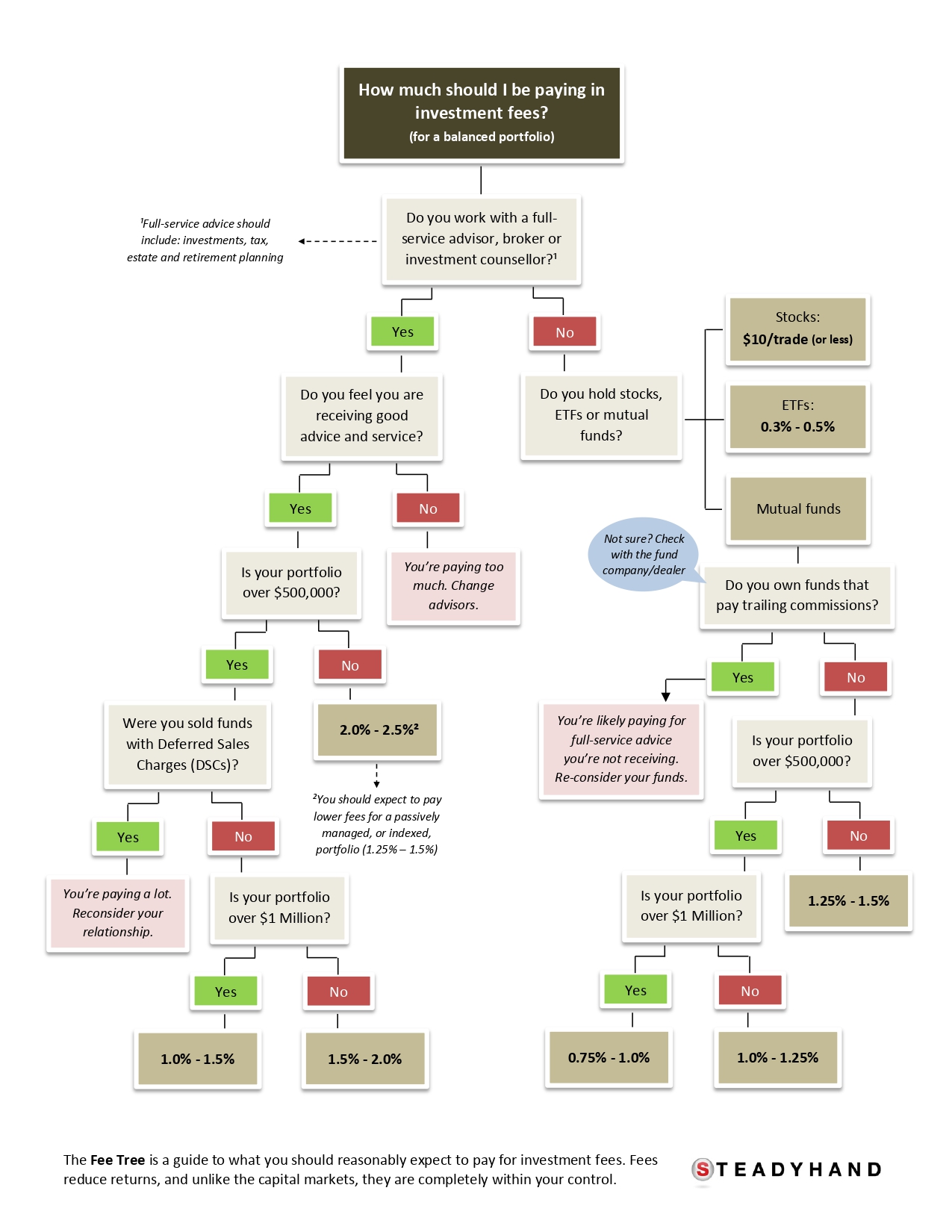

It comes down to one word: research. If you’re a self-directed investor, make looking at fees part of your regular research. If you are looking for the help of an advisor, make sure you thoroughly research your options. (Advisorsavvy can help!). This flow chart by Steadyhand is a great starting point:

Are investment fees negotiable?

Whether or not investment fees are negotiable depends on the provider.

Generally speaking, investment management firms with a real person managing your portfolio can be negotiated. On the other hand, investment fees incurred through a platform like Wealthsimple or Questrade are often fixed and non-negotiable. Regardless of the provider you’re interested in, it’s always worthwhile to inquire about negotiating the fees.

How to negotiate fees

The cost of financial advice isn’t avoidable unless you want to do all the work yourself. Fortunately, it is possible to negotiate a lower fee. If you are able to start an investment cost negotiation, here are some tips on how to approach the process:

- Prepare: It’s best if you go into a negotiation with prepped research and an idea of what you want out of the negotiation. Be sure that you understand their fee structure and have identified areas where you want to pay less before going into the negotiation.

- Scenario analysis: You may not get exactly what you want during a negotiation. It’s best to weigh the scenarios before so you know what you’re okay with and what you’ll walk away from.

- Know when to walk away: There should be a point in the negotiation process when you know to walk away. If you aren’t willing to pay a certain amount of investment management fees, that’s the point you should walk away and find another provider.

- Approach with positivity: In most cases, we won’t get what we want if we approach a situation with a negative attitude. When negotiating, be kind, respectful, and positive. You are more likely to reach a successful negotiation with the provider this way.

- Remember it is a relationship: Remember that this arrangement is a client-provider relationship. It’s not about you getting your way and the provider getting nothing in return. Be sure to approach the situation with a give and take attitude. As a result, both parties will mutually benefit, which is best for you in the long run.

Related Reading: Understanding Debt Solutions in Canada

How do you avoid paying fees when investing?

- Choose lower-cost options: ETFs, index funds, and no-load mutual funds have lower costs compared to more traditional investment structures. Consider these alternatives over higher-cost options.

- Trade less: Each trade comes with a variety of fees. By trading less, you will pay less. Keep in mind that this is usually true in self-directed investor situations.

- Robo-advisors: In Canada, robo-advisors have become very popular. They are also an affordable alternative.

- Online platforms: Wealthsimple, Questrade, and similar online platforms allow you to participate in self-directed investing for a cheaper cost. The onus, however, is on you to make informed investment decisions.

Takeaways

By now you might be thinking “all investment fees are bad.” This is not true. By putting your investments into a financial management product, you will normally earn more profits than simply keeping the funds in a savings account.

The question you should be asking yourself is, “what am I getting in exchange for the investment fees I pay?” Finally, if you’re looking to access some of the best financial advisors in Canada, check out our services!

Your financial situation is unique, and we can help you find the best advisor for your needs. Just fill out our short questionnaire.