One of the most highly discussed topics in Canadian personal finance right now is the housing market. And for good reason – there’s a lot of volatility and rapid changes occurring within the market. But the question remains, is there a housing crisis in Canada? And if there is, what’s causing it and how can Canadians navigate the problem? In this article, we’ll explore the nuances of the housing market and put it into terms that can be easily understood. Continue reading to learn more.

Table of contents

Is Canada having a housing crisis?

Technically speaking, Canadian officials have not declared a housing crisis in Canada. However, the biggest mistake in any crisis is failing to recognize that there is a crisis. In addition, most economic crises are discovered in hindsight, not while they’re happening. Or sometimes they’re discovered when chaos ensues, like we saw with the 2008 Financial Crisis. As with any widespread problem, there usually isn’t one single cause, but rather, many. Let’s explore some of the details below.

What is causing unaffordable housing?

Various factors are causing unaffordable housing, both from the rent and homeowner perspective. Below is a list of each factor and how it’s impacting the housing market.

Inflation

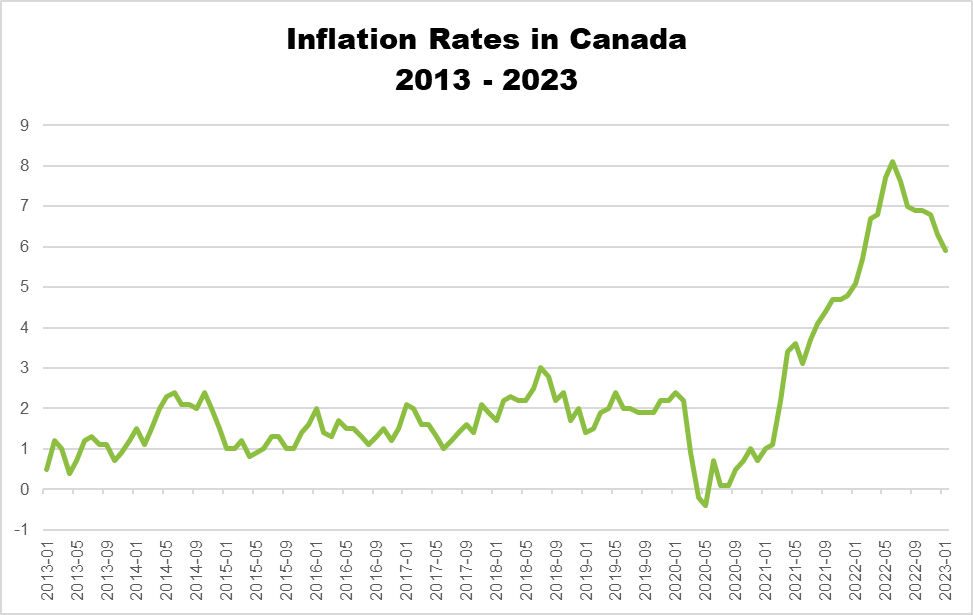

Many Canadians have witnessed the effect of inflation at the grocery store or at the gas station. However, it’s impacting rent and property prices too. For the last 10 years, inflation has been quite stable, remaining between 1% and 3%. However, at the end of 2021, it rose to 4.8%. And at the end of 2022, it was at 6.3%. Inflation affects everything, including the cost of housing.

Below is a graph of inflation rates in Canada over the last year. Fortunately, inflation seems to be going down as it was 5.9% in January 2023.

Low supply

When supply of any commodity is low, demand increases and, in turn, price increases. In Canada, the supply of homes is low, so this effect is occurring nationwide. But what’s causing the low supply of housing? There are two factors: foreign buyers and short term rentals.

For many years, foreign buyers were purchasing real estate in Canada because it was seen as a lucrative investment. However, this left many homes unoccupied and reduced the amount of available housing for Canadians. As of January 1, 2023, Canada banned foreign buyers from purchasing real estate in Canada. While this is a step in the right direction to preserve housing for Canadians, it doesn’t restrict foreigners who already own property in Canada. Plus it’s too soon to tell if it will help the housing crisis in Canada.

As for short term rentals, whether foreigners or locals, many are buying property and renting it out on a short term basis (less than a year). This leaves less property available for long term rentals or to purchase outright. This aspect is attributable to the disruptive technology of Airbnb. Before this tech company exploded, short term rentals weren’t nearly as popular.

Rising interest rates

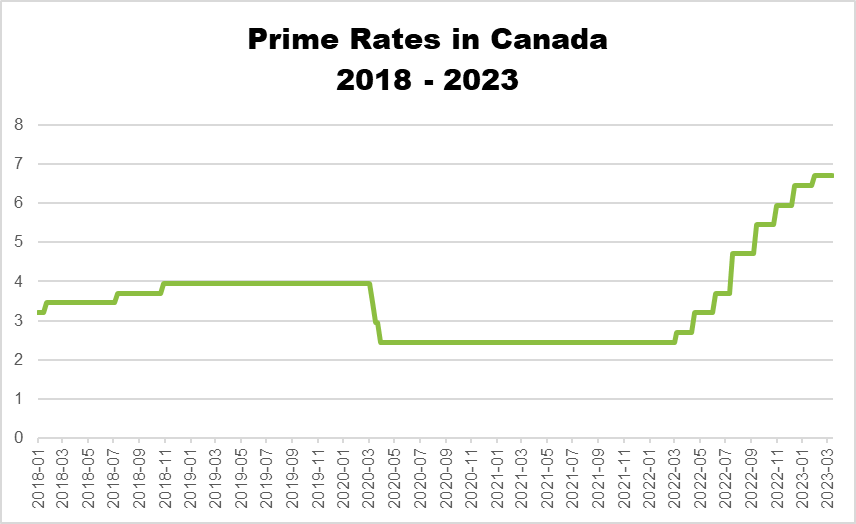

Since 2022, interest rates have been going up steadily. On April 14, 2022, the prime rate was 3.2%. Today, it’s 6.7%, double what it was a year ago. If you have a fixed rate mortgage, the interest rate hikes won’t affect you. But if you have a variable rate mortgage, the hikes can increase your monthly payment by hundreds of dollars. You can try to refinance, but the process is expensive and you still have to carry the mortgage until the refinancing is complete. Plus, if you want to obtain a mortgage now, your payment will be higher than normal regardless if it’s fixed or variable.

Below is a graph of the prime rates in Canada since 2018. As you can see, prime rates were quite stable prior to 2022 which made housing affordability more stable if you were a homeowner. But now, the cost of a mortgage is steadily rising. The Bank of Canada is increasing interest rates likely to attempt to cool inflation, which is working, but this puts financial pressure on homeowners.

Cost vs earnings

Despite the factors discussed above, rent or a mortgage payment is just a number. How much you pay isn’t as important as the relationship between the cost of housing and your earnings. So where does Canada stand?

In all of Canada, the average monthly rent rose to $2,024 in 2022. In previous years, the national average was closer to $1,800. That’s a roughly 12.5% increase which is growth that outpaced inflation! In terms of monthly mortgage payments, the national average is $1,440 as of Q3 of 2022. However, if you’re getting a new mortgage, that average rises to $1,910. As of September 2022, the average monthly income was about $5,094, for full-time workers. Compared to 2021 and 2020, Canadians were making more money in 2022.

All of this means Canadians are spending about 40% of their income on rent and 18% to 28% of their income on mortgage payments. The standard according to the Canada Revenue Agency is that you should be spending roughly 35% of your income on all housing costs – this includes rent or mortgage payments, utilities, food and other basic costs of living. If you purchase a home, the percentage of your income is not unreasonable at 18% to 28%. But bear in mind, this is only the cost of a mortgage. The figure excludes property taxes and other costs of homeownership. However, Canadians can only afford to buy a home if they have a down payment and can actually find a suitable property within their price range. If not, Canadians are forced to rent and 40% is well outside of the 35% benchmark.

Is there a housing shortage in Canada?

Yes, there is a shortage of housing due to foreign buyers and the surplus of short-term housing rentals. Many foreigners purchased property in Canada as an investment, not a place to live. Naturally, this reduces the homes available for Canadians. Fortunately, the Canadian government recently banned foreigners from buying property in Canada and implemented a vacant home tax.

As for short term rentals, many properties in Canada are being used exclusively for rentals under 12 months. A major culprit of this is Airbnb who infamously popularized short term rentals in residential properties as opposed to hotels. This reduces the amount of properties available for Canadians to rent on a long term basis, or even buy as a home.

What is the most unaffordable city in Canada?

Below is a list of the top 11 most expensive cities in Canada, along with the average rent, home price and cost of living. This list is not compiled in any particular order.

| Canadian City | Average Rent (1 Bedroom) | Average Home Price | Average Cost of Living (excl. housing) |

| Toronto, ON | $2,279 | $1M | $2,286 |

| Vancouver, BC | $2,500 | $1.4M | $2,298 |

| Markham, ON | $1,995 | $1.4M | $2,466 |

| Surrey, BC | $1,825 | $1.1M | $1,950 |

| Mississauga, ON | $2,122 | $1M | $2,225 |

| Victoria, BC | $2,095 | $1.6M | $1,906 |

| Kelowna, ON | $1,920 | $1M | $1,774 |

| Halifax, NS | $1,750 | $484K | $1,290 |

| Brampton, ON | $2,000 | $1M | $1,957 |

| Calgary, AB | $1,679 | $506K | $1,424 |

| Ottawa, ON | $1,700 | $525K | $1,867 |

Will home prices drop in 2023 in Canada?

At the end of the day, no one knows what will happen tomorrow in any given market. If we knew that, nothing would ever be a crisis! However, there are tons of economists studying the housing market in Canada, attempting to predict what will happen in 2023 and beyond.

According to Oxford Economics, housing prices are expected to fall by 30% by mid-2023. Subsequently, house price growth is expected to be more reasonable following this drop. In addition, Oxford Economics reported Canada housing is down 14% since February 2022. They anticipate another fall of 16% throughout 2023. Although, the severity of the decline depends on where you’re located in Canada. It is expected that regions which saw the highest gains would see the highest drops. For instance, in the Greater Toronto Area and Vancouver.

Desjardins reported a similar prediction. They forecasted the average home price in Canada will fall by 23% by the end of 2023. Desjardins believes a correction to the housing market is needed, but they did not anticipate for it to happen this quickly. Both of these figures are indicative that there is an impending housing crisis in Canada.

Is 2023 a good time to buy a home in Canada?

The answer to this question depends on your unique circumstances and personal finances. It all depends on what is available to you and what you can afford. But generally speaking, 2023 is not a good time to buy a home in Canada. There are many factors working against you, including:

- High interest rates. At the time of writing, the prime rate in Canada is 6.7%. For reference, the prime rate was below 4% in the 2010s. Because the prime rate is so high right now, you will pay more interest on a mortgage obtained during this time.

- Unpredictable, volatile market. The housing market is a hot topic in Canada because of the volatility and unpredictability. When markets are this way, it’s not an ideal time to enter because it’s more challenging to predict the outcome. A quote from the famous finance film, The Big Short, stated by Michael Burry demonstrates this, “Average take home pay is flat, yet home prices are soaring. That means homes are debts, not assets.”

- Impending drop. Many experts are forecasting a sharp drop in home price values, plus an overall correction to the market. If you were to buy now, you might incur a price drop in your newly purchased home, which is not ideal. Not only would you be carrying negative equity, you’d be making mortgage payments on a home that’s worth less than what you paid for it. It’s better if you wait until home prices drop, then buy low.

Is Canada’s housing bubble about to burst?

No one knows for sure what will happen, but many economic experts believe housing prices will drop significantly in 2023. Even if it doesn’t happen in 2023, the next few years of the Canada housing market are not likely to be favourable or stable. In fact, 2023 might be the year that a housing crisis in Canada is finally exposed.

How far will Canadian housing fall?

Experts predict Canadian housing will fall between 25% to 30% in 2023. As of February, housing prices have already fallen by 22% in the last year.

Will houses ever be affordable again in Canada?

Various economists anticipate housing will become affordable again by 2025. As mentioned, 2023 is likely to be a tough year for housing in Canada, but it will eventually recover. Further, all markets recover in the end so no financial crisis is forever!

Should I buy a house now or wait in Canada?

Ultimately, this is a very personal question. But on an aggregate scale, the answer is likely no. Between rising interest rates, instability in the market, and high inflation, it’s best to hold onto your cash and get through the next year. When the market is low, that’s an ideal time to buy.

Furthermore, housing is not the only way to build wealth. Yes, it is a tried and true method of building wealth, but you won’t effectively do so if the market is not performing well, like right now. At this time, you’re likely better off investing your money elsewhere. For instance, consider putting your money into stocks, bonds, mutual funds and ETFs. Many of these assets have declined in value and it’s easier to invest in smaller increments, whereas housing requires a lot of capital upfront.

Not sure how to proceed with your next investment? Consider consulting with a financial advisor. Find your perfect match today!