The past few years have been tumultuous for Canadians in more ways than one. Inflation has been a phenomenon that individuals and households across the country have experienced. But what exactly are the different types of inflation? Turns out, inflation isn’t a simple formula and there are a variety of ways to measure and assess it. For instance, it can be understood using principles of supply and demand, but it can be measured using the Consumer Price Index (CPI). Ready to learn more? Continue reading to understand the ins and outs of the various types of inflation.

Table of contents

- What is inflation made up of?

- How is inflation measured in Canada?

- What are the 3 main types of inflation?

- What are the components of Canadian inflation?

- What are Canada’s inflation trends?

- What is CPI inflation in Canada?

- What is the difference between CPI and PCE inflation?

- Is inflation bad in Canada right now?

- Why does Canada have such high inflation?

- How does inflation impact Canadians?

What is inflation made up of?

Inflation is defined as an increase in the prices of goods and services that households commonly buy. For instance, food, gas, and childcare are captured in these types of goods and services. On the contrary, deflation has the opposite effect. It is defined as the decrease in the prices of goods and services that households routinely buy.

Inflation might seem like a bizarre phenomenon. In essence, it is the concept of supply and demand. Whenever there are changes in supply and/or demand, it impacts prices, which is when we begin to experience the effects of inflation or deflation. A small degree of inflation or deflation is to be expected in any market. However, when inflation becomes volatile, it can be a sign of economic turmoil. In some cases, it can even cause or lead to a recession, or worse, depression.

How is inflation measured in Canada?

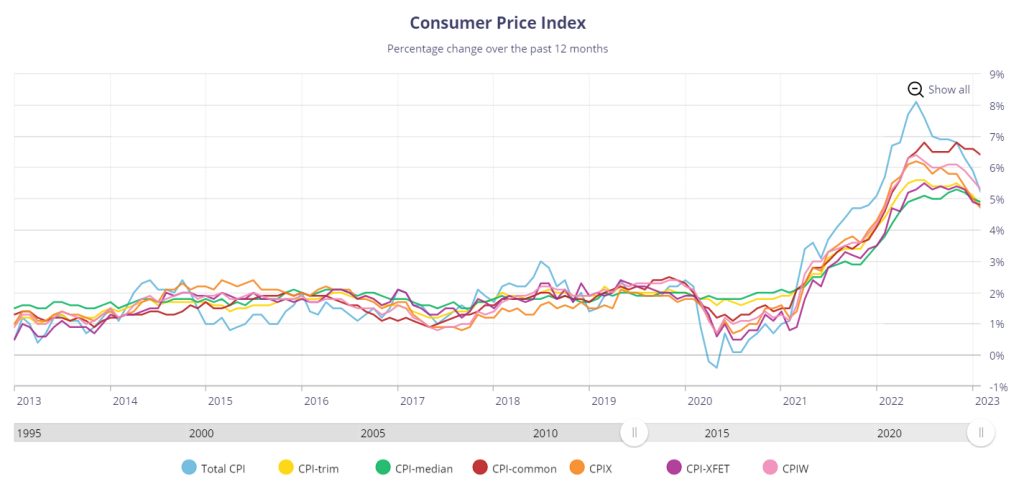

Inflation is measured using the Consumer Price Index, or CPI for short. The calculation of the CPI is conducted and communicated by the Bank of Canada. As defined by the Bank of Canada, “The Consumer Price Index (CPI) is an indicator of changes in consumer prices experienced by Canadians. It is obtained by comparing, over time, the cost of a fixed basket of goods and services purchased by consumers.”

Match to your perfect advisor now.

Getting started is easy, fast and free.

The Bank of Canada provides an array of different calculations of CPI. In general, they all follow the same path or trajectory more or less, as shown below. Although, the Bank of Canada is not terribly transparent about their calculation methods. As you can see from the graph below, inflation has steadily increased over the last few years, but appears to be cooling in 2023.

What are the 3 main types of inflation?

There are many ways to define and categorize inflation. However, the 3 main types of inflation pertain to principles of supply and demand. More specifically, when there are changes to supply and/or demand, it tends to trigger inflation. Let’s take a closer look at each type of inflation below.

Built-In Inflation

This type of inflation is the easiest to define because we have all experienced it first hand. Built-in inflation occurs when a large enough group of people expect inflation to continue indefinitely. As mentioned, normal inflation is between 1% and 3%. In a way, this perpetuates because people believe it will perpetuate. After all, financial systems are a human invention so they can never be free from social pressure.

A classic example of built-in inflation is when employees of a company expect their salaries to increase at the same pace of inflation. This is because the cost of goods and services is increasing with inflation. So to keep up, employees demand their salaries increase too. However, this type of inflation is not necessarily built on economic principle, but rather social pressure.

Match to your perfect advisor now.

Getting started is easy, fast and free.

Cost-Push Inflation

When prices rise as a result of increased production costs, this is known as cost-push inflation. Demand for the goods and services remains the same, but the cost of things like raw materials and wages increases.

A common instance of this type of inflation is when new legislation increases the minimum wage. The company has no other choice but to comply with the law. However, to keep their profit margins the same, they increase the price of their products or services.

Demand-Pull Inflation

When consumer demand for a product or service increases, it causes prices to increase. Supply will decrease with increased demand, thereby driving up the price. Normally, this type of inflation occurs when consumer confidence is high. Often this coincides with low unemployment rates. In other words, the economy is in a healthy state and things get thrown off balance due to increased demand.

Related Reading: Old Age Security Increase in 2023: What You Need to Know

What are the components of Canadian inflation?

As mentioned above, the Consumer Price Index tracks the performance of a “basket of goods and services”. But what is that exactly? In economic terms, a basket of goods and services represents consumer spending. It is used to track changes in prices, otherwise known as inflation or deflation.

The Bank of Canada uses the following goods and services to calculate their CPI:

- Food

- Shelter

- Household operations, furnishings and equipment

- Clothing and footwear

- Transportation

- Health and personal care

- Recreation, education and reading

- Alcoholic beverages, tobacco products and recreational cannabis

Technically speaking, there are millions of ways to measure inflation depending on what you use as the base. Ultimately, it depends on your goal and what you’re trying to measure. However, the above basket of goods and services is a good representation of the average Canadian household.

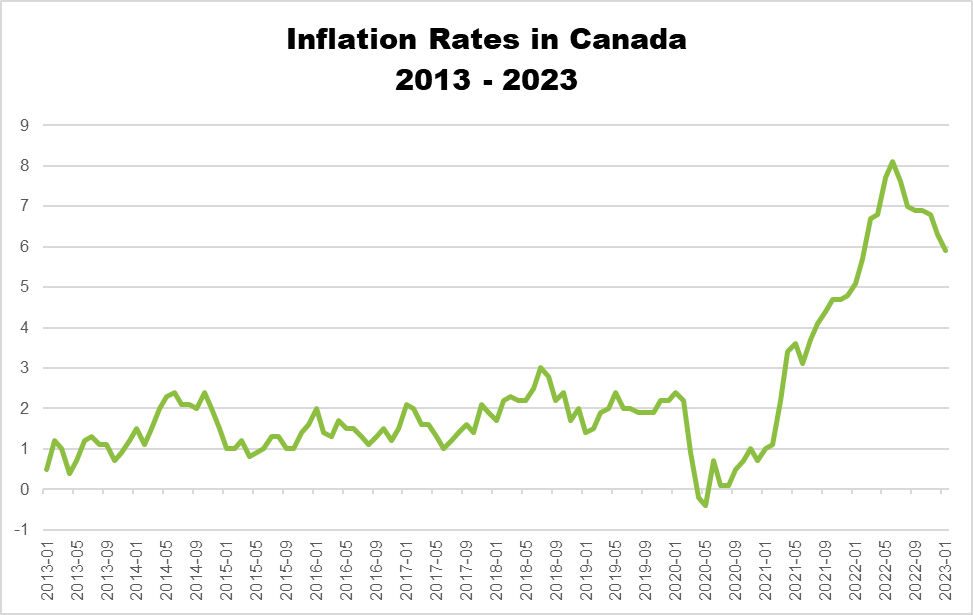

What are Canada’s inflation trends?

Inflation has been a hot topic in Canada recently – and for good reason. At the end of 2022, inflation reached a peak of 6.3%. Currently, it is about 5.2%, which means it has dropped about a full percentage point. For reference, inflation was in the normal range of 1% to 3% before the pandemic. However, inflation has become volatile following the pandemic as a result of supply chain disruptions and general aggregate economic change. This isn’t unique to Canada, most countries around the world are experiencing high, volatile inflation.

As mentioned, the inflation rate has dropped by about 1 percentage point since the end of 2022. This is a new trend considering it has been going up and up throughout the last few years. An explanation for this is the rising prime rates dictated by the Bank of Canada. When interest rates are low, it encourages consumer spending. In fact, you may have noticed a spending frenzy last year, particularly within the housing market. Now that interest rates have tripled, consumer spending has severely slowed because it’s more expensive to carry debt. As a result, inflation is cooling.

What is CPI inflation in Canada?

As of March 21, 2023, the inflation rate was 5.2%. Below is a graph which shows the inflation rate trends from the last 10 years.

What is the difference between CPI and PCE inflation?

There are many types of inflation and ways of measuring it. According to TD Economics, the Consumer Price Index (CPI) uses a narrower definition of consumer expenditures. It only considers urban expenditures that are incurred directly by consumers.

On the other hand, Personal Consumption Expenditures (PCE) Price Index measures expenditures made by both urban and rural consumers. In addition, it considers expenditures made on their behalf by third parties, such as health care insurance companies. In simpler terms, CPI inflation is more focused and PCE inflation is more broad.

Related Reading: Consumer Proposal vs Bankruptcy: What’s the difference?

Match to your perfect advisor now.

Getting started is easy, fast and free.

Is inflation bad in Canada right now?

Yes, inflation is bad in Canada right now. In a healthy economy, inflation is usually between 1% and 3%. The inflation rate is currently 5.2% which is well outside of the normal range. Many Canadians have experienced the high inflation first hand, such as at the grocery store or at the gas pump. If you’re struggling to cover your cost of living right now, you’re not alone!

The good news is inflation rates appear to be decreasing in 2023 as a result of interest rate hikes. Overall, this is positive for Canadians. However, on the individual level, interest rate hikes may cause a new kind of financial turmoil. More specifically, if you are carrying variable interest rate debt, the cost of your payment will increase drastically. While the cost of living might be decreasing, you may now be struggling to make debt payments.

Why does Canada have such high inflation?

High inflation is rarely caused by any single factor. Rather, it is a culmination of various factors that create a perfect storm of rising prices. These factors are currently affecting Canada’s inflation rates:

- Disrupted supply chains. Despite the pandemic happening 3 years ago, the disruption of supply chains is ongoing. Entities around the world continue to repair the damage which is transitional, but we’re still experiencing the effects.

- Excess demand. Financial support from the government, such as the Canada Emergency Response Benefit (CERB), helped millions of Canadians. However, it created excess demand which remains in our economy. When demand is high and supply reduces, price increases.

- Low prime rates. Recently, prime rates have sharply increased, but in 2021 and 2022 they were quite low. In fact, they were even lower than pre-pandemic numbers. This facilitated more consumer spending because it was cheaper to take out and carry debt. Unfortunately, Canadians who spent a lot during those years are paying the price now!

How does inflation impact Canadians?

The most immediate effect of inflation is decreased spending power. This means consumers can spend less money for the same amount of goods and services. As a result, households have to cut back on spending and be choosier about where their money goes. In terms of indirect or secondary effects, high inflation is often an indicator of an economy that’s performing poorly. This can result in other phenomena such as increased unemployment rates and a recession.

Are you struggling to manage high inflation and your budget in Canada? A financial advisor can help. Fill out Advisorsavvy’s survey to get matched with an advisor today!

Read More: Surviving Inflation: Top 7 Tips