Credit scores are used by lenders to decide whether or not to give you a loan and what interest rate to extend. Your credit score is also an important factor in how much you pay for car insurance, and can even affect your ability to get a job. For these reasons, it’s important to understand how your credit score is calculated in Canada.

The two credit bureaus use slightly different algorithms to calculate your credit score, but they all take into account your payment history, debt levels, and age of credit history. In other words, your credit score considers the same factors, regardless of the credit bureau.

Understanding how your credit score is calculated can help you make decisions that will build your credit. For example, if you know that you have a low credit score because you have missed payments in the past, you can work on making all of your payments on time and in full from now on.

Table of contents

By taking steps to improve your credit rating, you’ll be able to enjoy the benefits of a good credit score for years to come! Continue reading to understand credit score calculations and how you can take steps to improve yours.

What is a Credit Score?

A credit score is a numerical expression based on a statistical analysis of a person’s credit files, to represent the creditworthiness of that person. A credit score is primarily based on credit report information typically sourced from credit bureaus.

Lenders, such as banks and credit card companies, use consumer credit scores to evaluate the potential risk posed by lending money to new consumers. With this in mind, a high consumer credit score generally represents a lower risk of default, and therefore, a lower interest rate may be offered. In other words, a good credit score indicates someone who is likely to pay back their debt obligations. While a low credit score indicates someone who may default on their debt obligations.

Consequently, lenders will offer better terms – including lower APRs (annual percentage rates) – to borrowers with strong credit scores. It’s important to remember each lender has its own definition of what constitutes a “good” or “excellent” score. Therefore, it’s important for consumers to understand what range they fall into before applying for any type of loan or line of credit.

Related Reading: What is the average credit score in Canada?

Your credit score & report. Always free, forever

It takes 3 minutes to join 20+ million people who trust ClearScore to help them improve their financial future

What is a Credit Report?

A credit report is a summary of an individual’s credit history. It includes financial information such as credit card balances, loan payments, and other types of debt. Lenders use this information to determine an individual’s creditworthiness, in addition to the overall credit score.

A credit report also contains personal information such as your name, address, and Social Insurance Number. This information is used to verify the identity of the person seeking financing.

Credit reports are maintained by the two major credit reporting agencies, Equifax and TransUnion. These agencies collect information from financial institutions and public records to create a comprehensive report. Individuals can request their own credit report from each of these agencies once per year.

Credit Score Ranges and What They Mean

In Canada, credit scores range from 300 to 900. The lower the number, the higher the risk is that the borrower will default on their loan. There are ranges within credit scores which give a general idea of your creditworthiness. Check out the tables below for the ranges and some additional stats.

| Rating | Poor | Fair | Good | Very Good | Excellent |

| Range | 559 & Under | 560 – 659 | 660 – 724 | 725 – 759 | 760 & Over |

| % of Canada’s population in this range | 4% | 10% | 15% | 14% | 57% |

| % of borrowers who are close to default | 33% | 11% | 2% to 5% | 1% to 2% | 1% |

Related Reading: What is a Good Credit Score in Canada?

How is credit rating determined in Canada?

Credit bureaus calculate and determine credit ratings. They collect financial information about consumers and use it to generate credit reports. Credit bureaus in Canada are Equifax and TransUnion, they’re responsible for reporting the data. They are both for-profit companies owned by US shareholders. These organizations use a variety of methods to calculate credit ratings, including payment history, outstanding debt, and the length of time a consumer has had credit.

The input data for credit rating comes from public sources (including the courts) and voluntary sources (including lenders, collection agencies, and employers). Keep in mind that not all entities choose to disclose to credit agencies in Canada.

Your credit score & report. Always free, forever

It takes 3 minutes to join 20+ million people who trust ClearScore to help them improve their financial future

How is your credit score calculated in Canada?

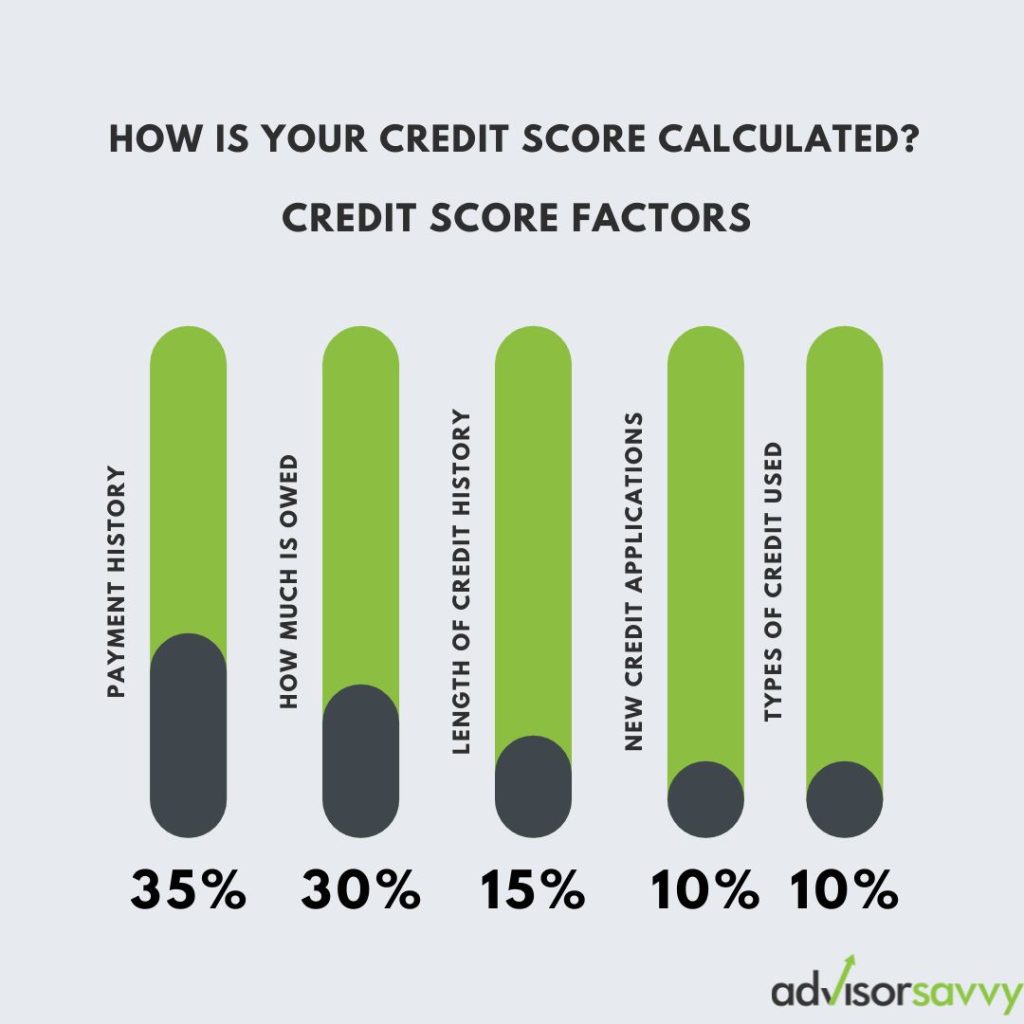

Five different factors affect the calculation of your credit score. Learn about each one and the weight it has on your overall score below.

1. Payment History (35%)

Payment history includes information such as whether bills were paid on time and in full, how often payments are missed, and whether any accounts are in collections. This information is used to give lenders an idea of an individual’s financial history and whether they are likely to default on a loan. Additionally, payment history is one of the easiest factors to improve, so even those with low credit scores can make changes that will have a positive impact on their score. Lastly, payment history has the greatest impact on your score so this isn’t a component to overlook!

2. How Much is Owed (30%)

This factor accounts for 30% of the total credit score and looks at the amount of debt a person is carrying relative to their credit limit. In other words, this is the credit utilization ratio. It’s important to keep credit balances low, as it indicates that you’re managing your debt load well.

3. Length of Credit History (15%)

Length of credit history contributes 15% to a person’s total credit score. This factor looks at how long ago accounts were opened and whether there has been consistent activity over time. Generally, longer credit histories are seen as more favorable by lenders. This is because they provide a more accurate picture of a person’s borrowing history and repayment habits. A shorter credit history may not be as predictive of future behaviour, making it more risky for lenders.

Related Reading: How to Check Your Credit Score in Canada

4. New Credit Applications (10%)

New credit applications make up 10% of a person’s total credit score. Whenever you apply for a new loan or credit card, lenders will pull your credit report and this will result in a small drop in your score. However, this effect is usually temporary and will dissipate over time. The reason it has an impact on your credit score is that borrowers with many new credit applications can signal financial distress.

5. Types of Credit Used (10%)

Finally, the types of credit you use make up 10% of your score. Lenders like to see a mix of different types of credit, such as lines of credit, installment loans, credit cards, and mortgages. Having a diversified mix indicates that you’re a responsible borrower who can handle different types of debt.

Related Reading: Secured Credit Card Canada

What is a typical credit score in Canada?

In Canada, the average credit score is somewhere between 650 and 725. However, scores of 600 or less are considered below average and indicate a higher-risk borrower. Having a credit rating that falls anywhere between 560 and 659 will make it more difficult to be approved for loans from banks and other traditional financial institutions.

With this in mind, it’s important to understand your credit score and take steps to improve it if necessary. This article is one of the numerous online resources that can help you do this, and it’s generally a good idea to start with a basic understanding of what your score means and how it’s calculated. From here, you can take steps to improve your credit rating by paying down debt, maintaining a good payment history, and using credit wisely. By taking these steps, you can improve your chances of being approved for a loan at favourable terms!

Read More: How to Improve Your Credit Score in Canada