They’re a top recommendation of investing legend Warren Buffet. They’re also great for new investors and/or those looking to follow a passive investing style. ‘Index fund’ sounds like a fairly technical term, doesn’t it? In reality, they’re pretty straightforward — and can be a great way of diversifying your portfolio at a low cost.

This guide will outline how index funds work, explain the pros and cons, and list some of the top funds in Canada.

Table of contents

What are index funds?

Simply put, an index fund is a type of mutual fund or exchange-traded fund (ETF) with a portfolio designed to match or track a specific market index. This might be the Standard & Poor’s 500 Index, or S&P 500, which is 500 of the top companies on the US stock market, or Canada’s benchmark S&P/TSX Composite Index.

For example, the iShares S&P/TSX 60 Index ETF (XIU) tracks the 60 biggest stocks on the TSX. As of November 5, these include Shopify, RBC, TD, Enbridge, and so on. Buying shares in XIU will allow you to hold stock in these 60, all in one go.

Related Reading: Best Dividend ETFs in Canada

How do index funds work?

As explained above, index funds match/track specific market indexes. Expanding on how these funds work, we need to look at two specific types of investing.

Match to your perfect advisor now.

Getting started is easy, fast and free.

Active vs passive investing

If you’re a novice investor, you might’ve come across the terms ‘active investing’ and ‘passive investing.’ With the former, a portfolio manager actively takes a hands-on approach to stock selection — typically working with analysts who look at various factors. Their goal is to, essentially, beat the market. As a result of this direct involvement by a portfolio manager and their team, both fees and risk levels are higher with active investing.

The latter is all about the long game and keeping a ‘buy-and-hold’ approach that’s cost-effective. Index funds are a form of passive investing, meaning there isn’t a lot of buying and selling happening within the portfolio. Holdings mirror/track a specific index, with returns gradually earned. It’s essentially relying on the market’s ability to generate positive returns over the long run. Active investing might pay off in the short term, but a passive strategy is an approach that’s often (historically) shown to result in higher returns.

Are index funds diversified investments?

Absolutely! Given that these funds are portfolios of stocks or bonds — all from a variety of industries and/or companies (small-, medium-, and large-cap) — it’s basically a “not all eggs in one basket” situation. One of your holdings takes a nosedive? If your portfolio is spread across sectors and stocks, one plunge won’t cause the whole thing to fall along with it. Simply put, the risk is much lower.

Related Reading: TFSA vs RRSP: Where to Put Your Money

Why invest in index funds?

Famously, index funds and passive investing are a top choice of Warren Buffett. As he wrote in a 2016 letter to shareholders:

“Over the years, I’ve often been asked for investment advice, and in the process of answering, I’ve learned a good deal about human behavior. My regular recommendation has been a low-cost S&P 500 index fund.”

But would index funds be the right choice for you, your portfolio, and your financial goals? Let’s break it down.

Related Reading: MER vs Management Fee: What’s the Difference?

Pros and Cons

At the top of the pros list? The above-mentioned baked-in diversification and low cost. Another significant benefit, however, is their accessibility. Anyone can start a basic online trading platform account and get started — typically in a matter of minutes. As we covered above, the passive strategy of index funds means that you’re not constantly researching or analyzing stocks — a time-consuming task that also requires a degree of investing knowledge. Finally, there’s also a degree of predictability. Index funds mirror the market, so it’s easy to see any fluctuations reflected in your holdings.

As for cons, just look at the flip side of the above list of pros. Index funds are certainly not going to be for really hands-on investors that want more control over stock selection. They’ll feel too limiting. They’re also not going to be for anyone looking for a short-term, ‘high-risk high-reward’ situation.

Index funds vs ETFs vs mutual funds

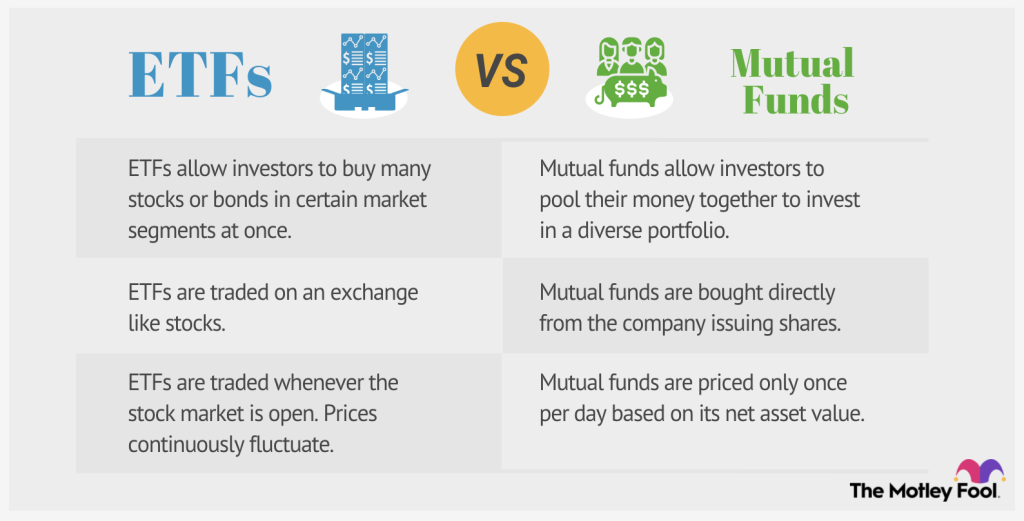

These three are more similar than you think. In fact, ETFs and mutual funds are just types of index funds.

As we’ve explained before, ETFs and mutual funds do share characteristics. Instead of investing in a particular company, an ETF is essentially a basket of securities that trade together on the stock market. ETFs are a mix of different types of investments, including bonds and commodities. They are managed by professional managers. Investors can access ETFs, including specific index ETFs, through a brokerage.

Mutual funds certainly sound a lot like ETFs. In a nutshell, they’re a group of investments within a single fund — still giving you that sought-after diversification. Where mutual funds differ, is that investors pool their money together to create the mutual fund, which is professionally managed and invested in a diverse portfolio like index funds. Interested investors buy and hold shares directly from the issuing company. Finally, unlike ETFs that fluctuate with the market throughout the day, mutual funds are only traded once a day — after the markets close.

How to Invest in an Index Fund

Index funds are available either through an in-person broker or trading platforms like Questrade or Wealthsimple. As we explained in previous articles, online/discount brokerages are a great option for experienced investors who are comfortable with self-directed investing. These platforms allow you to trade with little-or-no assistance from a broker. You receive no advice, planning, or other investment services, but you are legally able to buy and sell stocks. Robo-advisors, on the other hand, choose investments and manage a portfolio for the investors. As a result, these are appropriate for beginners who need a helping hand. They’re also great for investors that want more of a ‘set it and forget it’ approach.

Related Reading: 9 Investments that Pay You Every Month

Research

The key thing is to make sure you do some degree of research. Robo-advisors like Wealthsimple will often ask you a variety of questions during the sign-up process so they can build a portfolio for you. However, if you’re a self-directed investor, be sure to take a look at a fund’s main page, carefully reviewing all the numbers, investment objectives, risk levels, and more. For instance, here’s the information for the example we shared earlier, iShares S&P/TSX 60 Index ETF. One number to look for is a fund’s management expense ratio or MER. This will tell you the percentage of a fund’s assets that go toward operations and administrative expenses. For the S&P/TSX 60 Index ETF, the MER is (as of September 30, 2021) 0.18%. And of course, make sure you check out the actual price to buy into the fund!

Just remember: while index funds are considered low-cost and you don’t need much money to start, make sure you don’t invest more than you can afford to lose. Index funds are great for beginner investors, but they’re designed for long-term growth. Make sure you have the basics — i.e. emergency savings, debt repayment — taken care of first.

As always, be sure to consult your financial advisor with any questions you have about index funds and investing.

Related Reading: How to Invest in Mutual Funds in Canada

Best Index Funds for Canadians

Putting it lightly, there are a lot of index funds out there — including those by Canada’s major banks that mirror the country’s markets (eg. Toronto Stock Market, the Canadian Securities Exchange, the Vancouver Stock Exchange, and the TSX Venture Exchange). Here are 3 top index funds you might consider adding to your investment portfolio:

Note: All numbers accurate as of January 2024.

Vanguard FTSE Canada All Cap Index ETF (VCN)

This ETF tracks the FTSE Canada All Cap Domestic Index, investing primarily in large-, mid-, and small-capitalization Canadian stocks.

MER: 0.05%

AUM: $6.03B

iShares Core S&P U.S. Total Market Index ETF (XUU)

Want to own the entire US stock market — for a low cost to boot? Designed as a long-term holding, XUU replicates the performance of the S&P Total Market Index.

MER: 0.07%

AUM: $2.53B

iShares Core MSCI All Country World ex Canada Index ETF (XAW)

This ETF offers a low-cost way of owning US, international, and emerging market stocks, i.e. global portfolio diversification. It replicates the performance of the MSCI ACWI ex Canada IMI Index. Canadian equity or bonds are not included (i.e. ‘ex Canada’).

MER: 0.22%

AUM: $2.18B

Low-cost index funds

As explained above, index funds are inherently lower in cost than other investment avenues, like mutual funds. You’ve also likely come across the specific term “low-cost” index funds. What are these? Simply put, they have low expense ratios (i.e. the MER or management expense ratio). If you’re just starting out with investing, these funds are a great option. Two examples of low-cost index funds are:

iShares S&P/TSX 60 Index Fund (XIU)

Fun fact: this ETF was the first in the world! It seeks long-term capital growth by replicating the performance of the S&P/TSX 60, net of expenses, through exposure to large, established Canadian companies. XIU is also one of the most liquid ETFs in Canada. Given how diversified it is, having XIU in your portfolio can reduce your risk.

MER: 0.18%

AUM: $11.9B

iShares Core S&P/TSX Capped Composite Index ETF (XIC)

Want to own all of the Canadian stock market? This ETF is low-cost, and a long-term core holding by design. It tracks/replicates the performance of the S&P/TSX Capped Composite Index.

MER: 0.06%

AUM: $10.5B

Read More: 4 Types of Income