With tax season just around the corner, it’s important to understand the different types of tax returns in Canada. Each tax return has a different purpose as well as varying inputs to calculate your tax liability. To understand more about which tax returns you need to file and when, continue reading below.

Table of contents

What are tax returns in Canada?

Tax returns are annual, quarterly or monthly forms used for tax compliance and payment. Inputs, such as income and expenses, determine your tax liability or refund. Most Canadians only file taxes on an annual basis, but it depends on your unique circumstances. Taxation is typically the largest source of income for the government, including in Canada. Financial data and taxes are collected by the government using tax returns.

Match to your perfect advisor now.

Getting started is easy, fast and free.

How taxes in Canada work

In Canada, taxes apply at the federal and provincial/territorial levels. Before calculating tax, you must determine your taxable income which is the sum of your income less any deductions or eligible expenses. Everyone pays the same rate of tax at the federal level according to tax brackets, but the tax brackets vary by province and territory. Therefore, the final amount of tax you pay depends on where you live.

But what are tax brackets? The Canadian system is progressive, sometimes called graduated. This means the more money you earn, the more tax you pay. The cut offs of income where you pay more tax are the tax brackets. For the 2022 tax year, these are the federal tax brackets:

| 2022 Federal Income Tax Bracket | 2022 Tax Rate |

| $0 to $50,197 | 15% |

| $50,198 to $100,392 | 20.5% |

| $100,393 to $155,625 | 26% |

| $155,626 to $221,708 | 29% |

| $221,709 and above | 33% |

Once you determine your tax liability using your taxable income and tax brackets, it’s time to deduct tax credits. After deducting all the tax credits you’re eligible for, you will arrive at your tax payable or refund.

How taxes work in Canada varies if you’re self-employed, own a corporation, or have a trust. In these instances, the tax rates and process are similar to what’s described above, but do vary slightly since there are unique circumstances.

Here are some additional resources to consider for Canadian taxation:

Related Reading: Marginal Tax vs Average Tax: Understanding Canadian Tax Brackets

What are the 3 main types of taxes in Canada?

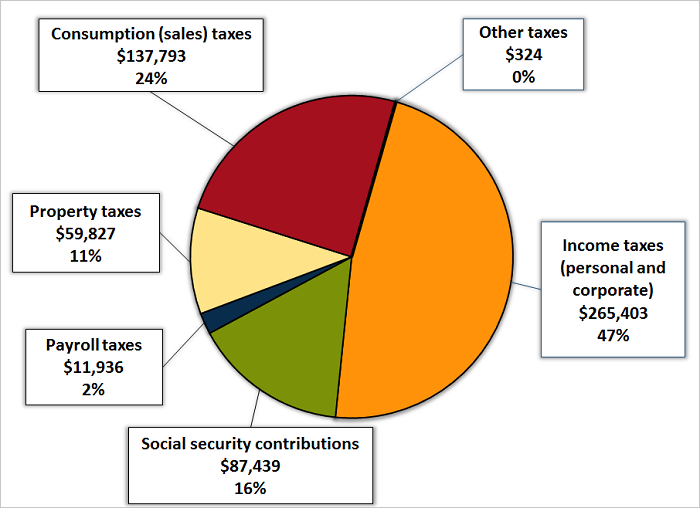

According to the Canadian government, the 3 main types of taxes include income taxes, sales taxes and social security contributions, such as Employment Insurance, Canada Pension Plan and Quebec Pension Plan. The rates at which these contribute to government revenue are 47%, 24% and 16%, respectively. Take a closer look below:

As you can see, income tax contributes the most to government revenue and part of that process is completing your annual tax return.

What are the different types of tax returns?

To collect income taxes in Canada, there are three main types of tax returns in Canada:

- T1 – Personal: The T1 is the standard personal tax return for all Canadian individuals. Every Canadian citizen must fill out a T1 annually. If you are a resident of Canada, you likely have to complete a T1 as well.

- T2 – Corporate: The T2 is the tax return for registered corporations in Canada. To complete one of these returns you would use your company’s financial data. Proper record keeping is essential for a T2 return.

- T3 – Trust: The T3 is used to file taxes for a trust in Canada. Trusts are their own separate, individual entity which is why they have their own tax return.

Everyone needs to complete a T1 personal, but you only need to complete a T2 if you have a corporation. In addition, you only need to complete a T3 if you have a trust. All three of these returns are completed on an annual basis.

What other types of tax returns are there in Canada?

As we saw above, the Canadian government collects other taxes outside of income tax. Below are other tax returns you might have to file:

- Sales tax returns. If you’re a registered business, you might have a sales tax account with the Canada Revenue Agency. If you’re a small supplier (earning less than $30,000 per quarter), you are not required to register for a sales tax account, but some opt to open one anyway. If you’re a large supplier, you definitely file and report sales taxes. On a sales tax return, you report the difference between sales taxes collected and paid. Sales tax returns are often filed quarterly, but some companies might file monthly or annually.

- Payroll tax returns. If you’re a registered business with employees, you must have a payroll tax account with the Canada Revenue Agency. This account is used to collect and remit employer taxes, including CPP, EI and federal taxes. Employers deduct taxes from their employee’s pay at the source and remit it to the CRA on their behalf. Normally these tax returns are filed monthly, but sometimes it can be quarterly or annually. In addition, employers are often required to file Employer Health Tax (EHT) returns too.

- Final tax returns. A final tax return is filed in the year which someone dies. This return is used to pay the final taxes of the deceased before the estate is distributed to beneficiaries.

- Other tax returns. Under special circumstances, you might have to fill out additional tax forms or returns. Consult a financial advisor or accountant if you’re unsure.

Related Reading: Estate Taxes in Canada

What is the most common type of tax return?

The T1 personal tax return is the most common type of tax return in Canada. It must be filed by every single Canadian citizen and most residents. Other types of tax returns do not get filed unless certain criteria and conditions are met.

Important deadlines for tax returns

Here are important deadlines to keep in mind for tax returns:

- January 1 to December 31: The tax year period.

- February 28: The deadline for T4 tax slips to be submitted to the Canada Revenue Agency and employees.

- March 1: Last day to contribute to a Registered Retirement Savings Plan (RRSP) to utilize the RRSP tax deduction.

- April 30: The deadline to file and pay taxes with the Canada Revenue Agency for T1 personal.

- June 15: The deadline to pay taxes if you’re self-employed for T1 personal.

T2 corporate tax returns are due 6 months after the corporation’s year end. T3 trust tax returns are due 90 days after the trust’s year end.

Do all Canadians have to file an income tax return?

All Canadians have to file a T1 personal income tax return. However, filing of other tax returns, such as a T2 or T3, is only necessary if you meet certain criteria.

Filing taxes might seem like a pain, but remember it finances the shared resources Canada offers. For instance, public schools and free health care. Be sure to fulfill your civic duty by completing and filing your annual income tax return! In addition, there’s an incentive to file your taxes every year because it allows you to access other benefits such as EI and CPP should you ever need them.

Filing tax returns in Canada

Now that you know more about the different types of tax returns in Canada, you’re ready to prepare for the tax season! Begin gathering documentation, such as T4s, self-employment financial data and corporate profit and loss statements, to get started on your tax returns. If you ever need assistance navigating the Canadian tax system, be sure to consult a financial advisor!

Read More: Best Free Tax Software in Canada