Many Canadians have worked for years and years to enjoy a relaxing retirement. Unfortunately, you might be able to cease employment in retirement, but you can’t avoid taxes! Reducing and optimizing taxes in retirement looks different than when you were working. So how exactly do retirees maintain tax efficiency in their golden years? In this article, we’ll explore tax efficient retirement withdrawal strategies in Canada and how you can incorporate them into your personal finances. Continue reading to learn more.

Table of contents

- Why does tax efficiency matter in retirement?

- How can I reduce my taxable income in retirement in Canada?

- How to Create a Tax Efficient Retirement Withdrawal Strategy

- What is the best retirement withdrawal strategy?

- What is the best way to draw income from your retirement savings in Canada?

- Advantages of a Tax Efficient Retirement Withdrawal Strategy

Why does tax efficiency matter in retirement?

In Canada, we are fortunate to have access to an array of public services. However, this comes at a cost – high taxes. Tax efficiency matters at all stages of life, but especially in retirement. In other earlier stages, if you aren’t tax efficient, chances are the burden isn’t as great because you’re working and have steady income. But in retirement, more tax means less retirement savings. It’s important to preserve what you have to ensure you can live a comfortable, stable life in your golden years. Ready to start finding efficiency in your taxes? Let’s start with the tax brackets and how it pertains to retirement income.

Related Reading: Top 10 Retirement Planning Tips For Canadians

Match to your perfect advisor now.

Getting started is easy, fast and free.

Understanding Tax Brackets, Tax Rates and the Taxation of Retirement Income

For the 2022 tax year, the federal tax brackets and tax rates are as follows:

| 2022 Federal Tax Brackets | 2022 Federal Tax Rates |

| $0 to $50,197 | 15% |

| $50,197 to $100,392 | 20.5% |

| $100,392 to $155,625 | 26% |

| $155,625 to $221,708 | 29% |

| $221,708 and above | 33% |

Remember these are only federal tax brackets and rates. Provincial or territorial tax will also apply on your retirement income. You can use your combined tax rate to estimate your tax burden at the federal and provincial/territorial level.

Not all retirement income is equal because retirees usually rely on a blend of income sources and savings. So what’s taxable and what’s not? Below is a table of common taxable and non-taxable financial sources paid to retirees.

| Taxable Retirement Income | Non-Taxable Retirement Income |

| • Registered Retirement Savings Plan (RRSP) withdrawals • Registered Retirement Income Fund (RRIF) payments • Canada Pension Plan (CPP) payments • Old Age Security (OAS) payments • Employer and other pension payments • Annuity payments • Employment and/or self-employment income | • Tax-Free Savings Account (TFSA) withdrawals • Withdrawals from non-registered savings accounts (capital gains tax may apply on the sale of investments) • Emergency funds • Inheritances • Guaranteed Income Supplement (GIS) payments |

Obviously, non-taxable retirement income sources don’t need to be reported on your tax return. These types of income should be optimized where possible to reduce your tax liability. As for the taxable retirement income sources, these should be managed in a way where you can stay in the lowest possible tax bracket. This way, you’ll pay less tax.

Need help with your retirement calculators? Check out our handy calculators!

How can I reduce my taxable income in retirement in Canada?

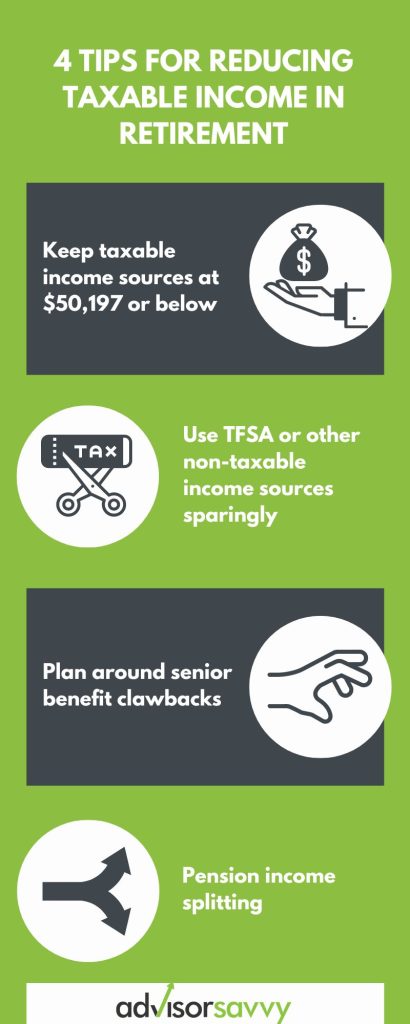

Here are some pro tips to reduce your taxable income in retirement:

- Keep taxable income sources at $50,197 or below. To remain in the lowest federal tax bracket, do what you can to keep your income below $50,197. This way, you’re only paying 15% tax and not being pushed into a higher tax bracket. Also consider provincial and territorial tax brackets. Try to keep your income below the threshold of the lowest tax bracket in your region too. In most cases, this aspect refers to your RRSP because you can control withdrawals from your account.

- Use TFSA or other non-taxable income sources sparingly. Since these income sources are not taxable, you should preserve them. It’s best to use these sources in the event of an emergency or in response to an unanticipated expense. This way you won’t have to unexpectedly withdraw a larger amount of money from your taxable sources, like an RRSP, and pay more tax.

- Plan around senior benefit clawbacks. Benefits programs for seniors are sometimes subject to clawbacks, such as the OAS clawback. By understanding the income thresholds, you can avoid the clawback so you don’t end up paying more tax. Ironically, less is not more in this circumstance. In fact, you should keep income between $25,000 and $75,000 to optimize these kinds of benefits.

- Pension income splitting. You can split your pension income with your spouse or common-law partner. If one of you is in a higher tax bracket, this can bring you both into lower tax brackets so you’re paying less tax overall.

After reducing your taxable income, you can also take advantage of lucrative tax credits. These will further reduce your tax liability in retirement and more credits become available in your retirement years.

How to Create a Tax Efficient Retirement Withdrawal Strategy

Everyone’s personal finances look different, including in retirement. For instance, some might have a pension and access to benefits, whereas others might rely on their savings and investment portfolios. Regardless of your financial situation, it’s best to create tax efficient retirement withdrawal strategies in Canada that suit your personal circumstances. Since everyone’s personal finances are unique, there is no one size fits all solution. Rather, you’re going to have to assess your finances and figure out the best way to optimize your taxes.

If you’re struggling with your tax efficient retirement withdrawal strategies in Canada, consider consulting with a financial advisor. They can help you create a plan and stick to it!

Related Reading: What Are The Best Retirement Plans?

Match to your perfect advisor now.

Getting started is easy, fast and free.

What is the best retirement withdrawal strategy?

In Canada, the three main types of retirement income are RRSPs, TFSAs and government benefits. There are a variety of ways to optimize withdrawal strategies around these financial engines depending on your individual circumstances. However, let’s take a look at some common tax efficient retirement withdrawal strategies for Canada below.

Tax-Efficient Withdrawal Strategies for RRSPs

It’s best to maximize RRSP or RRIF withdrawals early in retirement. There isn’t much of a benefit to delaying withdrawals. This is especially true if you plan on delaying CPP, GIS and OAS benefits. Remember, when you start claiming OAS, you will be subject to the clawback if your income is over the threshold. You don’t want to be in a position where you have to report higher income from your RRSP and can’t avoid the OAS clawback. Finally, by withdrawing more from your RRSP early on in retirement, you can reduce the taxable minimum withdrawal amount of your total RRIF down the road.

If you have excess income from your RRSP or RRIF in a particular year, put it into your TFSA. Don’t have room in your TFSA? You can also put it into a spouse or common-law partner’s TFSA or into a non-registered savings account. This way you can pay tax on the RRSP or RRIF withdrawal now and have that money set aside for when you need it later.

Tax-Efficient Withdrawal Strategies for TFSAs

Thankfully, TFSA withdrawals are not considered taxable income in the eyes of the Canada Revenue Agency. For this reason, it’s best to conserve your TFSA withdrawals until later on in retirement or when you really need it. For instance, if an unexpected, hefty expense arises and you don’t have the cash to cover it, use your TFSA. By doing so, you’ll be able to cover the cost without putting yourself in a higher tax bracket.

As mentioned above, you should put any excess income into your TFSA if you don’t intend to spend it. This way, the money will already have been taxed and put away safely for when you need it.

Government Benefits and Tax-Efficient Retirement Planning

In Canada, there are three main government benefits that are meant to supplement retirement income: Canada Pension Plan, Guaranteed Income Supplement and Old Age Security. Most retirees use a blend of these three benefits, plus any other income sources, to make ends meet during retirement. Let’s explore the nuances of these three programs and related tax-efficient retirement planning below.

Canada Pension Plan

You can start withdrawing from CPP between the ages of 60 and 70. It is best if you can hold off on CPP withdrawals until later on in life. For every year before the age of 65 that you withdraw from CPP, you lose 7.2% of the total value. In other words, if you start claiming CPP at age 60, you lose 36% of the total value. Furthermore, for every year after the age 65 you delay claiming CPP, you earn an extra 8.4% of the benefit. So, if you wait until age 70 to claim CPP, you’ll receive an extra 42%.

Obviously, waiting to claim CPP for as long as possible will ensure you receive a higher benefit amount. In addition, delaying CPP payments also delays taxable income. For this reason, it’s best to rely on other sources of income until you’re 70, then start claiming CPP.

Old Age Security

Canadians can start claiming OAS when they reach the age of 65. Similar to CPP, you can delay claiming OAS until age 70 and receive 36% more of the benefit. Again, it’s best if you can rely on other sources of income until you reach age 70, then start claiming OAS.

The drawback of beginning to claim OAS is the clawback. In 2022, if you earned more than $81,761, you were required to pay back some or all of your OAS benefits. For this reason, you’ll have to keep an eye on your taxable income and keep it below the OAS threshold. Otherwise, you’ll have to pay more tax.

Guaranteed Income Supplement

If you’re eligible for OAS, then you might qualify for GIS too. This benefit is only available to low income seniors and it is not taxable. For this reason, you can simply claim GIS and not have to worry about the impact on your taxes.

Related Reading: CPP vs OAS: What are the differences?

What is the best way to draw income from your retirement savings in Canada?

Everyone’s personal finances are unique which means the best tactic varies from Canadian to Canadian. But in general, it’s best to delay CPP and OAS in the early stages of your retirement and rely on RRSP or RRIF withdrawals. When you start receiving CPP, OAS and possibly GIS, rely less on RRIF and RRSP withdrawals to remain in a low tax bracket. Lastly, use TFSA withdrawals and other non-taxable income sources sparingly. Since no tax applies on these amounts, it’s best to preserve them for times of need.

Advantages of a Tax Efficient Retirement Withdrawal Strategy

Tax efficient retirement withdrawal strategies in Canada can help you optimize your overall finances by reducing your tax burden. While it all may seem complex now, it gets easier the more you understand all the moving parts. It can also preserve your golden years and ensures financial stability is not a concern for you.

Not sure where to start with your own tax efficient retirement withdrawal strategy in Canada? Reach out to a financial advisor who can help you today!

Read More: Tax Efficient Investing Canada