Living pay cheque to pay cheque is a common experience for many Canadians. In fact, the Angus Reid Institute, a non-profit organization, did a recent study on the matter. They found Canadians are feeling the financial pressure of inflation which has left little to no income after paying for necessities like groceries, gas, housing and so on. In addition, 45% of Canadians reported their financial situation has worsened in the last year. Their report also found that if monthly expenses were to increase by as little as $300, 66% of Canadians would not be able to afford the increase. Or they would have to make major changes in their lifestyle to afford the raised cost of living. As you can see, many Canadians are living pay cheque to pay cheque!

Table of contents

While it may seem like an impossible task, there are ways to break the cycle and start saving money. In this blog post, we’ll explore some of those methodologies. Read on if you’re tired of living pay cheque to pay cheque — we’re here to help!

What does living pay cheque to pay cheque mean?

Living pay cheque to pay cheque is a common term that is used to describe the state of financial insecurity many Canadians experience today. This situation arises when a person’s income does not cover all of their expenses, and they must rely on a regular influx of money from their next pay cheque in order to make ends meet. Oftentimes, this cycle leads to chronic stress and anxiety. Individuals attempt to juggle debt payments, bills, mortgages, and living expenses while never seeming to have any cash left for saving and investing. In addition, financial stress can heighten if an unexpected expense arises that the next pay cheque cannot possibly cover.

There are many factors that can contribute to living pay cheque to pay cheque, including high housing costs, inflation and low wages. However, some individuals also struggle due to increased spending, a toxic relationship with money, or poor budgeting skills. Whatever the cause, living pay cheque to pay cheque can be extremely stressful and debilitating, leaving many people feeling trapped in a vicious cycle of financial instability.

Related Reading: Best Chequing Accounts in Canada

Do most Canadians live pay cheque to pay cheque?

The cost-of-living crisis continues to put a strain on Canadian budgets. From groceries to transportation to housing, it’s been a struggle to make ends meet. The BDO Canada Affordability Index reports that three percent more people are struggling to make ends meet this year compared to last year. In total, 54% of Canadians reported they’re living pay cheque to pay cheque in 2022. Eight out of ten respondents say their finances have worsened in the past year, and they don’t see any improvement on the horizon.

Furthermore, 66% of respondents said they have enough money for essentials, which is down from 70% last year. This indicates that paying for necessities is becoming more difficult. Meanwhile, debt is a concerning issue as 82% of people surveyed their levels of debt have increased from last year. A staggering 42% of people say that their debt has gotten so out of hand that it’s now tough to manage — almost double the 2021 rate.

As you can see, many Canadians are living pay cheque to pay cheque. Much of this is due to external factors, such as the rising cost of food, high gas prices and the housing crisis. However, that doesn’t mean you have to keep on living this way. There are solutions!

Related Reading: Credit Counselling: A Complete Guide

How do I stop living cheque to pay cheque?

One of the biggest challenges in breaking the cycle of living pay cheque to pay cheque is finding a way to start living within your means. This can be easier said than done, especially if you’re used to spending without strict limits or restrictions. In addition, it’s always hard to make a change and stick to it — finances or not. However, there are some key steps that you can take to help you stop living this way and start working towards financial stability instead.

Below we’ll cover some strategies to implement to stop living pay cheque to pay cheque. In some cases, bigger changes may be necessary, such as downsizing your home or moving somewhere with lower property taxes or utility costs. Regardless of what approach works best for you, making these adjustments will enable you to put more money towards paying down debt or contributing toward savings goals.

Building long-term financial security requires taking advantage of opportunities to earn additional income. This could mean taking on a second job temporarily or investing in yourself through training designed to increase your marketability in the workplace. Alternatively, if you have focused on cutting expenses but still find yourself with extra cash at the end of each month, putting that money towards repaying debts faster can help you decrease the interest paid while making progress against other obligations. With any luck, these efforts will allow you to slowly build up enough resources so that one day you won’t be living pay cheque to pay cheque anymore.

Let’s take a look at some strategies you can implement today.

CIBC Investor’s Line Offer

Up to $6.95 per online stock or ETF trade. Plus, there’s no minimum account balance.

1. Create a budget and stick to it

To effectively manage your finances, it is essential to create a budget and stick to it. This means identifying your monthly income, as well as all of your expenses, including rent or mortgage payments, utilities, food costs, transportation costs, and any debt payments you may have. Once you have a clear picture of where your money is going each month, you can set specific goals for managing these expenses, such as cutting out extraneous spending or finding ways to reduce your utility bills. You may also want to explore alternative options for some of your typical expenses, such as looking into more affordable housing options or using public transportation instead of driving every day.

Related Reading: Budgeting Tips For Canadians

2. Build an emergency fund

An emergency fund is a crucial asset for anyone facing unexpected financial challenges. Such challenges can include everything from sudden medical expenses to job loss or unexpected home repairs. By having an emergency fund in place, you can rest assured that you will always have access to the funds you need, no matter what situation you are dealing with.

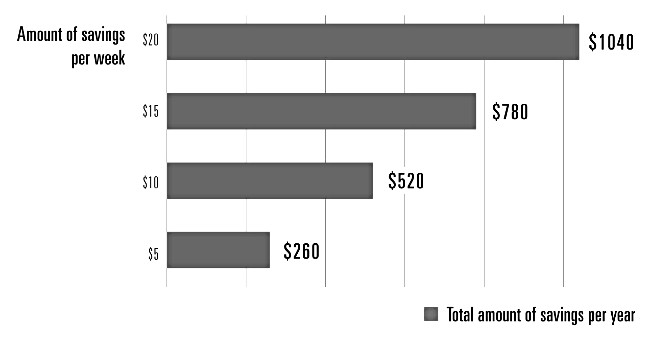

This fund can be built gradually over time by depositing a set amount of money each month into a savings account. You can also set up automatic transfers from your paycheck so that money comes out before it ever has a chance to be spent elsewhere. Does this feel impossible? It’s not! Check out the below chart to see how much you’ll have in your emergency fund by saving a small amount each week. Having a few hundred dollars set aside can do wonders for your finances. And if you keep up the saving habit? You’ll gain even more financial stability over time.

3. Switch to cash

One effective strategy to stop living pay cheque to pay cheque is to switch to cash only. This involves avoiding the use of credit cards and lines of credit, and instead relying solely on cash for your everyday expenses. There are several benefits to this approach. Firstly, it keeps you from spending more than you have, so that you can avoid running up high levels of debt in the long run. Secondly, making purchases with cash forces you to be more mindful about where your money is going, helping you to make wiser decisions about how to spend. Finally, a cash-only system eliminates the need for costly banking and interest fees related to using credit or debit cards.

Related Reading: Best No-Fee Bank Accounts in Canada

4. Cut expenses

As many people are aware, there are a number of strategies that can be used to cut expenses. For instance, one might consider switching to a less expensive cell phone plan or canceling cable TV in order to lower monthly costs.

Another effective strategy is to evaluate one’s spending habits and look for ways to make changes. After examining recurring bills and other purchases, it is often possible to find small ways to reduce one’s expenses without compromising quality of life. For example, one might choose a less expensive grocery store or start shopping for clothes at discount outlets rather than department stores.

5. Relocate

Housing costs are one of the biggest contributors to financial stress in Canada right now. Fortunately, there are cheaper places to live within our massive nation. While relocation is a more extreme approach to stop the pay cheque to pay cheque cycle, it may be necessary. Who knows, maybe this is the fresh start you need!

If you’re living in major cities like Toronto or Vancouver, it may be time to accept defeat with the housing markets and go elsewhere. If you still like city life, Calgary, Montreal and Halifax are great alternatives. Or perhaps you’re ready to try suburban or rural life where you’ll spend even less on housing. Lastly, if you really want to stay where you are, you could consider downsizing to a more affordable home.

Related Reading: Cheapest Place to Live in Canada

6. Change careers

Another way to fight the pay cheque to pay cheque cycle is by finding a higher paying job. This tactic can be tricky because sometimes to find a higher paying job education or other outlays of cash are required. However, that doesn’t mean you can’t get creative. There are a ton of free courses and resources out there to begin upskilling. In addition, you can consider your skills and where they might be transferable.

If you’ve been in the same job for more than 3 years, it may be time to find a new job. A study by ADP, payroll processing giant, showed that frequent job switchers earn more than those who stay at jobs long term. This was true for both white collar and blue collar industries. The reasoning is companies tend to have bigger budgets to hire new talent compared to the budgets for retaining existing talent. Every time you switch jobs, you can negotiate a higher salary until you’re in a more comfortable position financially. Even though this may feel like playing the system, it might be a necessary step to get a higher salary for yourself. And don’t think for one second that corporations aren’t playing the same game!

Find Financial Bliss

It is possible to break the cycle of living pay cheque to pay cheque. It begins with looking at your own spending and saving habits and finding where you can make small changes that will have a big impact. From there, you can start working towards your financial goals, whether that means getting out of debt or building up your savings. There are many resources available to help you on your journey to financial bliss, so don’t hesitate to seek them out.

Read More: 5 Steps to Transforming Your Relationship with Money