As Canadian taxpayers, we’re always looking for opportunities to save our tax dollars. If you have an advisor or someone else managing your finances, you might be wondering if the financial advisor fees are tax deductible. In this article, we will explore the rules surrounding financial advisor fees and tax deductions in Canada. We will also take a look at other expenses similar to financial advisor fees that you may be able to claim. Read on for more information!

Table of contents

- What are financial advisor fees?

- Are financial advisor fees tax deductible in Canada?

- What about other financial management fees?

- What financial fees are tax-deductible in Canada?

- Can I deduct fees related to an investment sale?

- Are financial planning fees tax deductible?

- Are legal fees tax deductible?

- Are accountant fees tax deductible?

- How do I claim investment fees on my taxes in Canada?

What are financial advisor fees?

Financial advisor fees are incurred by Canadians who have opted to invest their money with a financial advisor. In exchange for their services, financial advisors charge a fee, commission or a hybrid of both. The amount and fee structure depend on various factors, including the size of the fund, the services being rendered, and the experience of the advisor.

Advisory fees can range from 0.5% to 2.5% of the account value per year, which is generally lower than what you would pay for actively managed mutual funds or other investment products. However, it is important to note that not all financial advisors are equal. Some offer more comprehensive services than others, which may result in higher fees.

Financial management fees you might incur

There are several financial management fees you might incur, as listed below.

- Management fees. Management fees are the cost of a financial professional to manage your money. These fees can be charged hourly, monthly, or as a percentage of assets under management.

- Broker fees. This is the fee for a brokerage firm to manage your finances. These fees can vary depending on the type of service provided and the amount of money invested.

- Commissions. Commissions typically arise when buying or selling securities. They are the cost to execute an order with a financial professional.

- Trading fees. Trading fees are the cost to execute an order on the stock market or other similar marketplace. Sometimes the terms trading fees and commissions are used interchangeably.

- Legal fees. Legal fees arise when pursuing or defending a legal action. In this case, it would be a legal process related to your finances, such as divorce, inheritances or finalizing the sale of real property.

- Accounting fees. The cost to prepare financial statements or other financial services rendered by a professional accountant.

- Fees for services. Service fees are usually a one-time charge for a specific financial service, such as tax preparation or estate planning.

- Robo-advisor fees. Some people use robo-advisors to manage their funds. There is usually a fee for this service which is generally cheaper than human-run options.

- Management expense ratio (MER). The management expense ratio (MER) is the percentage of your assets that is taken out each year to cover the costs of running a mutual fund or another similar type of investment.

Related reading: What is a fee-only financial planner?

Are financial advisor fees tax deductible in Canada?

In Canada, fees paid to a financial advisor are not tax deductible. This is because the fee is considered to be a personal expense. Generally, only business or self-employed-related expenses are tax deductible.

With that said, there are some exceptions. For example, if financial advisor fees were incurred to generate business income, it could classify as a business or self-employed expense. In these scenarios, the individual usually must be self-employed with investing activities being their primary source of income. In this instance, the individual would be generating business income. This means expenses, like financial advisor fees, are usually tax deductible. However, financial advisor fees could also be incurred to make other types of business income.

Keep in mind that financial advisor fees cannot be deducted against income earned in a TFSA, RRSP or another registered account. These accounts are designed for personal use only, not business use. For this reason, the income earned there is never considered business income under any circumstances.

For the average Canadian, financial advisor fees are not deductible. But if you have a business or you’re self-employed and incur advisor fees, consider consulting a professional to confirm tax deductibility.

What about other financial management fees?

As mentioned, there are other kinds of financial management fees beyond financial advisor fees. Continue reading to learn more about the tax deductibility of these other costs.

Are trading fees tax deductible?

In Canada, trading fees are generally not tax deductible. For many people, investing is a form of passive, not active income. Passive income does not qualify as business or self-employed revenue which means expenses cannot be deducted against it.

However, if you are a full-time trader, then you may be able to deduct your trading fees. Consider consulting a professional to confirm eligibility.

Are brokerage fees tax deductible in Canada?

Generally speaking, brokerage fees paid for the management of a non-registered account are tax-deductible. This includes fees for buying and selling securities, as well as annual or monthly management fees.

The key thing to consider is what account the brokerage fees relate to. Registered accounts, such as RRSPs and TFSAs, are exempt from brokerage fee deductions. In other words, brokerage fees are not deductible under any circumstances within these accounts. They are only deductible within non-registered accounts.

What financial fees are tax-deductible in Canada?

The Income Tax Act outlines specific rules for the deduction of financial fees. One of the criteria for deductibility is the expense amount is reasonable. This means the amount is not excessive in comparison to the investments and income in question. The rules can be tricky to navigate, below is a table that summarizes what is tax deductible and what isn’t.

| Tax deductible | Not tax deductible |

| Fees paid for advice on buying and selling investments | Commissions and trading fees |

| Accounting fees for maintenance of financial records (only if there is a business/individual is self-employed) | Fees paid for other kinds of advice, such as financial counselling or planning |

| Fees related to the collection and remittance of income (only if there is a business/individual is self-employed) | Stockbroker fees (unless the fee was incurred to gain advice on the buying and selling of investments) |

| Fees directly chargeable against income | Fees incurred for TFSA, RRSP or another registered account |

| Brokerage fees for non-registered accounts | Subscription fees to financial magazines, newspapers or other outlets |

Keep in mind the above table is a general guideline. There are a lot of requirements and rules to navigate. If your circumstances are unique or difficult to define, consider consulting a professional to confirm eligibility.

Can I deduct fees related to an investment sale?

When it comes to investment sales, the general rule is costs incurred in connection with the sale are tax deductible. This could be lawyer, accountant, or financial advisor fees to settle a transaction.

However, this deduction is limited to the capital gain from the sale. A capital gain is defined as the difference between the selling price and the original purchase price of the asset. You can deduct eligible fees directly related to the sale. From there, half of the capital gain is subject to taxation in Canada.

To claim fees related to the sale of an investment, you must prove it was a direct cost. Be prepared to provide financial records in the event of an audit.

Are financial planning fees tax deductible?

No, financial planning fees are not tax deductible. In addition, financial counselling fees are not tax deductible. This is because they are considered personal expenses. Remember, financial advisor fees are only deductible if they are incurred to receive advice on the buying and selling of investments.

Are legal fees tax deductible?

In most cases, the answer is no, you cannot deduct legal fees. This is especially true within TFSAs, RRSPs and other registered accounts which are designed for personal use.

However, there may be special circumstances when legal fees are eligible for deduction. Legal fees may be tax deductible if they are incurred in the course of carrying on a business or deriving business income. In other words, it would be considered a business expense. The only other exception would be if legal fees were incurred to sell an investment. In most instances, you would be able to deduct these fees from your capital gain.

Are accountant fees tax deductible?

The answer is usually no, accountant fees are not tax deductible. Similar to the legal fees above, the only exception would be if the accounting fees are considered a business expense. Normally accounting fees are incurred to maintain financial records or for the collection and remittance of income. Or, if accounting fees were incurred to complete the sale of an investment as a direct cost.

How do I claim investment fees on my taxes in Canada?

As an overview of what was already discussed, three key criteria must be met to deduct financial management fees:

- First, the amount of the fees charged must be reasonable.

- Second, the fees must have been incurred for the purpose of earning income.

- And third, there must be a legal obligation to pay the fees.

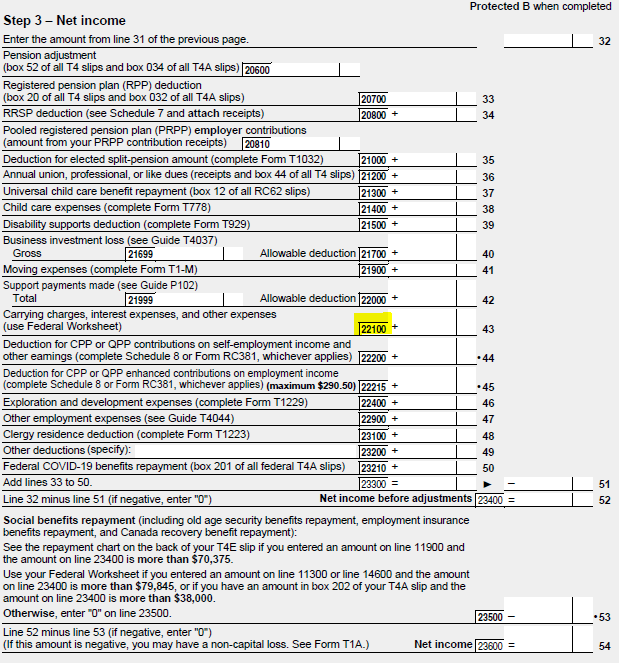

The fees paid to your advisor are claimed on Line 22100 of your tax return. When you’re ready for tax season, be sure to have the total amount and receipts in order. Line 22100 is under the Net Income section, as shown below.

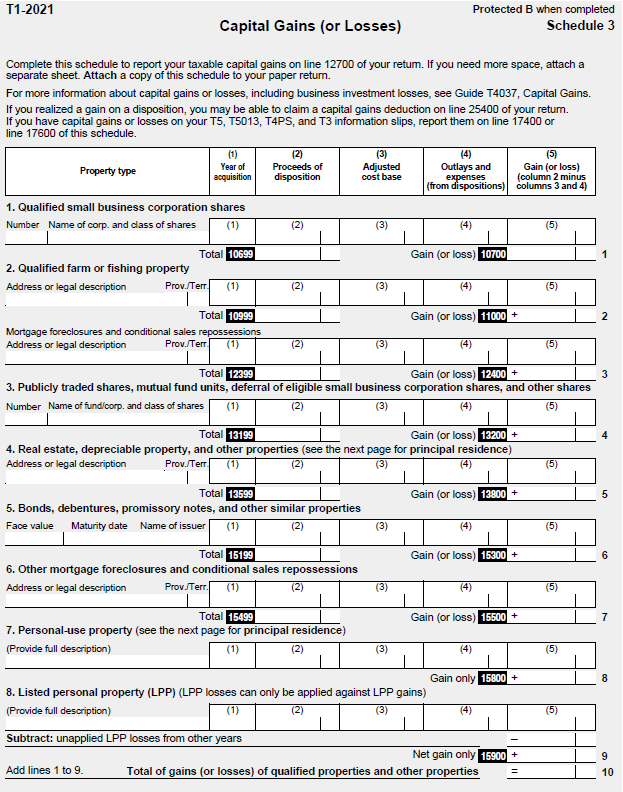

If you sold an investment during the year, you must complete Schedule 3 as a part of your tax return. This schedule outlines the capital gains or losses you incurred. You’ll notice column 4 is titled “Outlays and expenses (from dispositions)” in the photo below. This is where you would put financial advisor or other related fees to the sale of your investment if the amount is eligible for deduction.

The CRA is well aware that some entities have used investment management fees as a way to reduce tax liability. They will closely scrutinize any claims that appear to be excessive or unjustifiable. Be sure to keep your paperwork in order and think through the eligibility criteria carefully before making a claim. If you’re stuck, consider consulting a professional. With that said, as long as you can demonstrate your investment management fees meet all three of the above criteria, you should be able to claim them on your taxes without any problems.